Four supply chain initiatives to take back your power from your suppliers

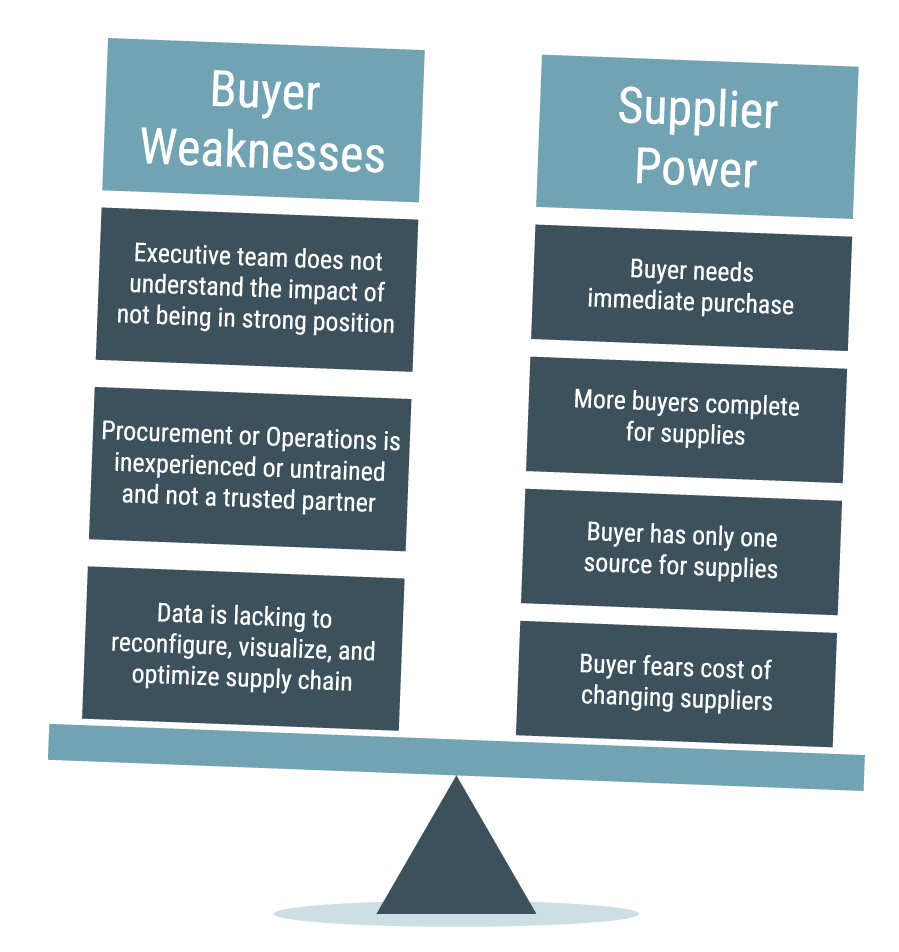

Suppliers with power are able to raise prices, arbitrarily decide which companies they will work with, and issue threats when their demands are unmet. That power increases if a company fears to change suppliers or balks at the cost of switching; if the company’s procurement function is new, untrained, or siloed; or if the company has no insight into the potential value it is leaving on the table.

Four supply chain initiatives help companies to take back power from their suppliers: honing the skills of procurement; embracing supplier optionality; re-evaluating the relationship between suppliers and procurement; and making the supply chain visible.

If you find yourself in any of the true-life situations described in the examples below, you too can benefit from taking back power from your suppliers.

1. A mature procurement department uses its skills for win-win negotiations with suppliers

A manufacturer of performance polymers experienced a major turnover in procurement staff; the new staff were not only inexperienced but also did not understand strategic procurement in an inflationary economy.

As in many companies, the procurement function in this example started life in a purely transactional role and never moved beyond that. From leadership to staff, they lacked the training necessary to make them full-fledged partners in decision making. Once their negotiating skills were sharpened, supply chain costs dropped 6%.

To enter into win-win negotiations with suppliers, they needed to:

- Collect data to support data-driven discussions about reducing costs.

- Build supplier relationships before requesting a proposal, especially in inflationary times when suppliers are more selective.

- Enter into win-win negotiations; for example, when the supplier and the company both benefit from volume rewards and consolidation of purchases.

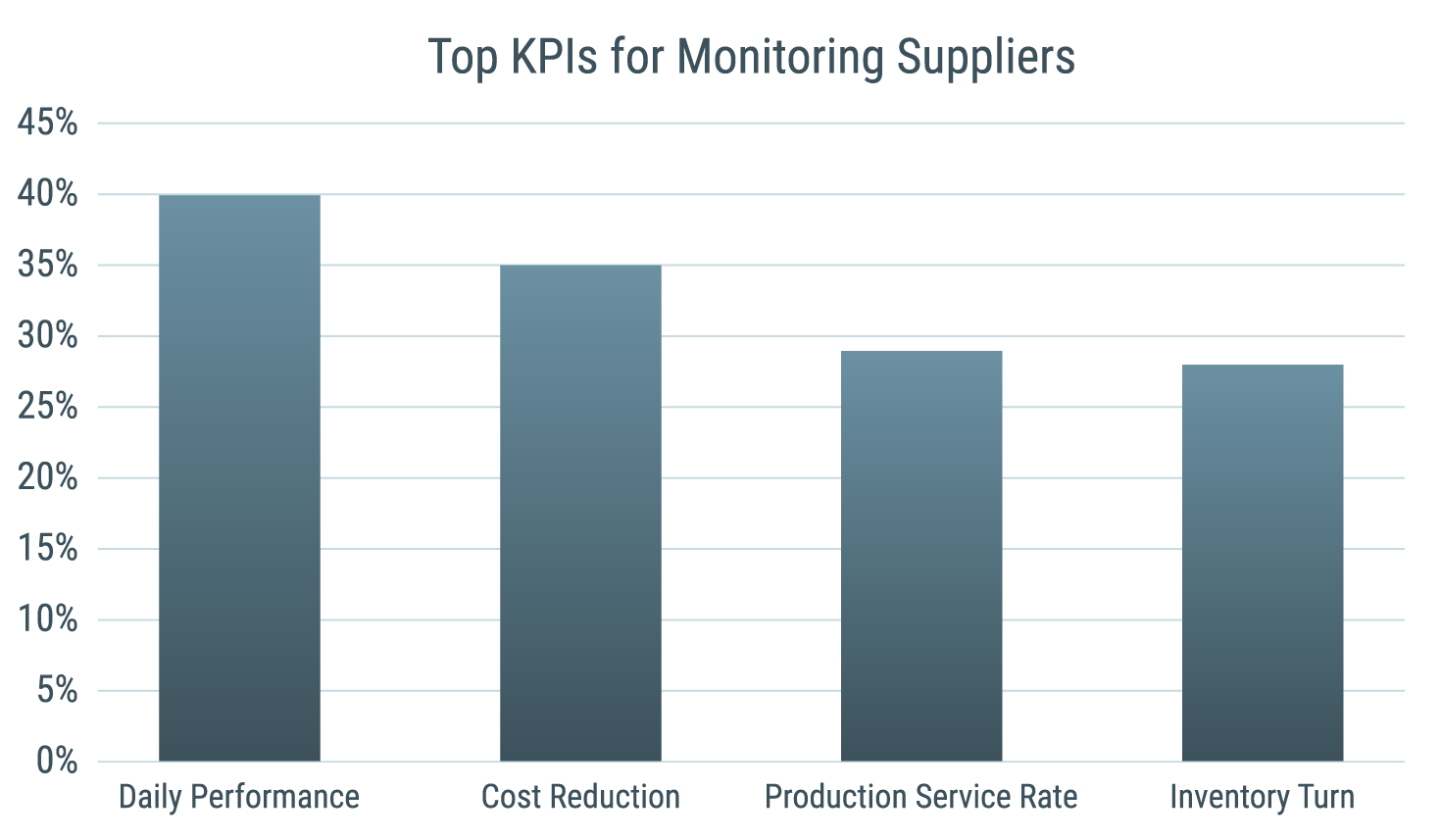

- Standardize sourcing and collect supplier performance data, to create consistency in monitoring and evaluating new and long-term suppliers.

- Promote leadership and organizational improvement (LOI) by providing the tools, skill sets, training, and collaboration that upgrades decision making and strategic thinking at all levels.

(Source: https://www.zippia.com/advice/supply-chain-statistics/)

(Source: https://www.zippia.com/advice/supply-chain-statistics/)

2. Supplier optionality reduces risk and the cost-of-goods sold

A consumer goods company faced rapid demand but could not fill orders, in part due to their reliance on a few key suppliers.

When a company becomes tied to just a few suppliers in a few locations, the risks to the supply chain increase exponentially. In this case, a 300% increase in demand left them scrambling. It was past time to meet with, qualify, and certify new suppliers. In a sharply constrained market, they were able to de-risk their supply chain with new domestic suppliers but also identify 3.5% savings in a high inflation market.

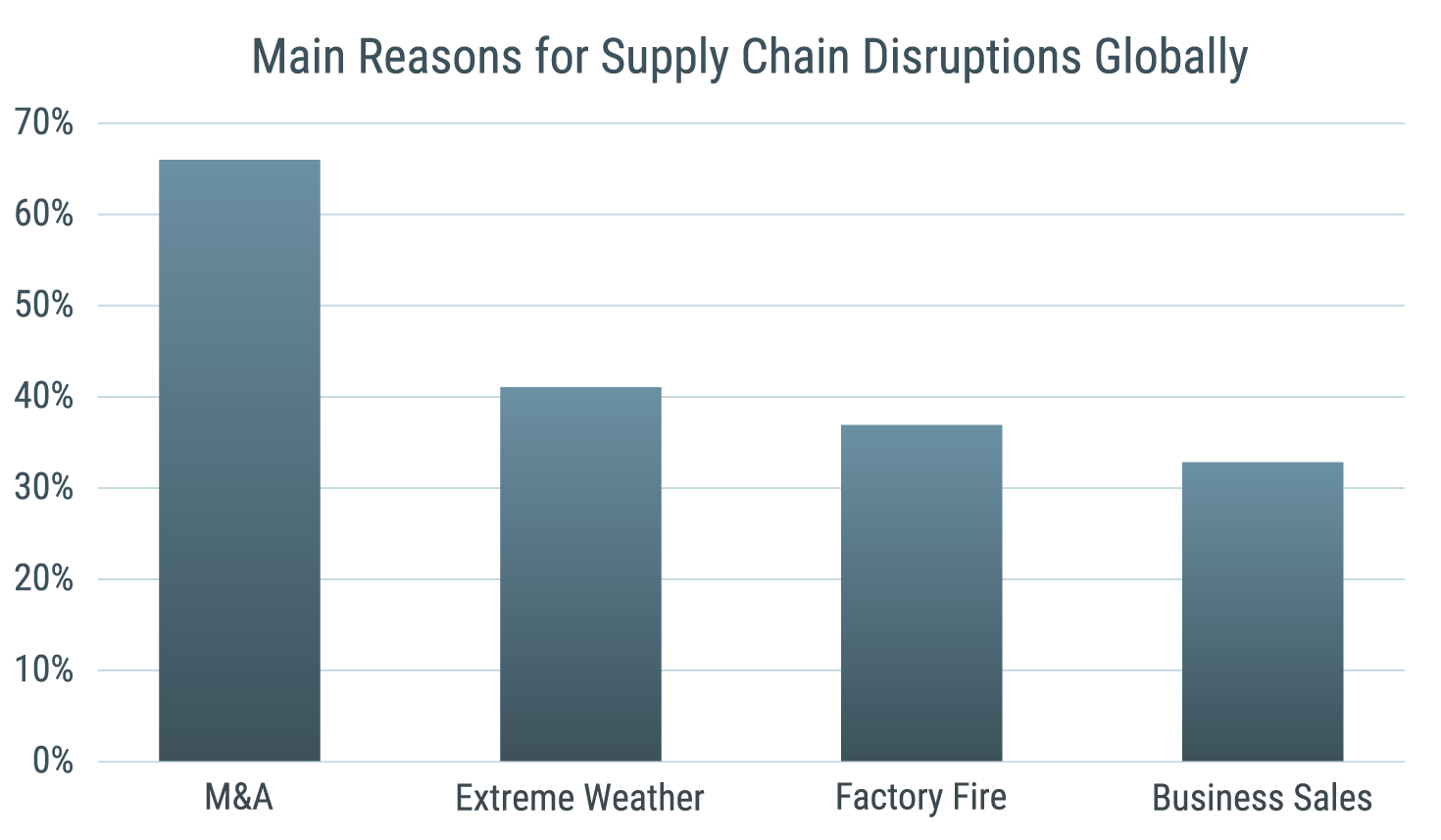

Sole sourcing is often develops because procurement, engineering, or operations believe that no other sources exist. Reliance on a single location develops when that location is regarded as the least expensive alternative, without accounting for other disruption risks that might arise from, say, a longer supply chain.

(Source: https://www.zippia.com/advice/supply-chain-statistics/)

(Source: https://www.zippia.com/advice/supply-chain-statistics/)

A supply risk model assesses the company’s current exposure to the collapse of a single-source supplier or a single geographic area; it also evaluates the potential for optionality. The company can find alternatives among in-shore, off-shore, and near-shore suppliers if they:

- Develop robust procurement strategies.

- Hold supplier forums, in which the company’s needs are presented to incumbent suppliers and the suppliers have a chance to act as strategic partners in meeting those needs.

- Conduct global sourcing events, including C-level meetings with potential new suppliers.

- Create an accelerated accreditation process based on previous supplier performance data and proven criteria.

3. Re-evaluating the supplier/procurement relationship improves savings and quality

A food processing and distribution company depended on import brokers for its products. The company had limited knowledge of their suppliers’ costs and capabilities.

This case illustrates how some companies establish supplier relationships that work against their own best interests. Once the company switched 50% of its purchasing to a direct procurement model, they were able to take control of both quality and costs, for a 27% savings.

Another sort of problem arises if procurement is not the primary contact with suppliers. At one company, that role was taken over by design engineers. Even after sending out their purchase order to suppliers, the engineers continued to make daily, costly changes that eventually frustrated suppliers into threatening to quit. A DfX initiative reduced changes from daily to zero and with a strengthened procurement function rescued the supplier relationships.

Among other initiatives a company needs to:

- Re-examine its Make Identity to ensure it is consistent with the company’s financial health and growth.

- Clarify roles—who is the owner, responsible, consult, and inform parties—to prevent confusion over the role of procurement or its place at the decision making table.

- Track procurement spend: who is ordering what and where is the order going?

- Establish KPIs and metrics to evaluate the value of changes before they are promised or made.

4. Increased supply chain visibility undercovers hidden problems—and opportunities

A manufacturing company struggled with low on-time in-full (OTIF) customer fulfillment, $27M of inventory that they couldn’t unload, and a high cost per unit. They placed the blame on warehouse management but they were mistaken.

The company lacked at least three essential ingredients for finding the root causes of their problem: an effective SIOP process, cost-to-serve metrics, and an executive dashboard. With a master resource schedule, vision boards, SIOP reports, and warehouse tracking to increase visibility into their supply chain, they were able to improve cost per unit 16%, productivity 240%, and dock shipping days 821%.

Supply chain visibility begins with trustworthy data and requires that companies:

- Eliminate silos that prevent the flow of information.

- Establish a single source of truth: ensure that the right information is being measured, captured, and made available to executives in a timely manner.

- Perform advanced data analytics to build supply/demand forecasts and to analyze spending, supplier defect rates, lead times, supplier availability, inventory turnover, and so on.

- Use simulations or supply chain twins to visualize the effect of changes before they are initiated in the real world.

SGS Maine Pointe has helped companies in every industry to increase the skills of procurement, take advantage of supplier optionality, re-evaluate supplier/procurement relationships and roles, and bring visibility to the entire plan-make-buy-move supply chain. Companies that commit to those initiatives create sustainable change in the power dynamic with their suppliers even during times of economic turmoil.