$100m EBITDA Opportunity For Oil Refiners

North American oil refiners who are not fully leveraging maritime shipping could add tens, if not hundreds, of millions of dollars to their bottom line over the coming year. Now is the time to re-evaluate your sourcing and logistics strategies, capitalize on the opportunity to buy cost-advantaged crude directly from international markets and ensure low-cost, efficient transport to improve margins.

As the CFO of a 300KBPD refiner tells it, a $1 per barrel impact on margins would result in $100M saving annually, meeting the company’s 5 year savings target in just 1 year.

2 key factors driving this opportunity

1. Over-supply of oil resulting in plummeting crude prices

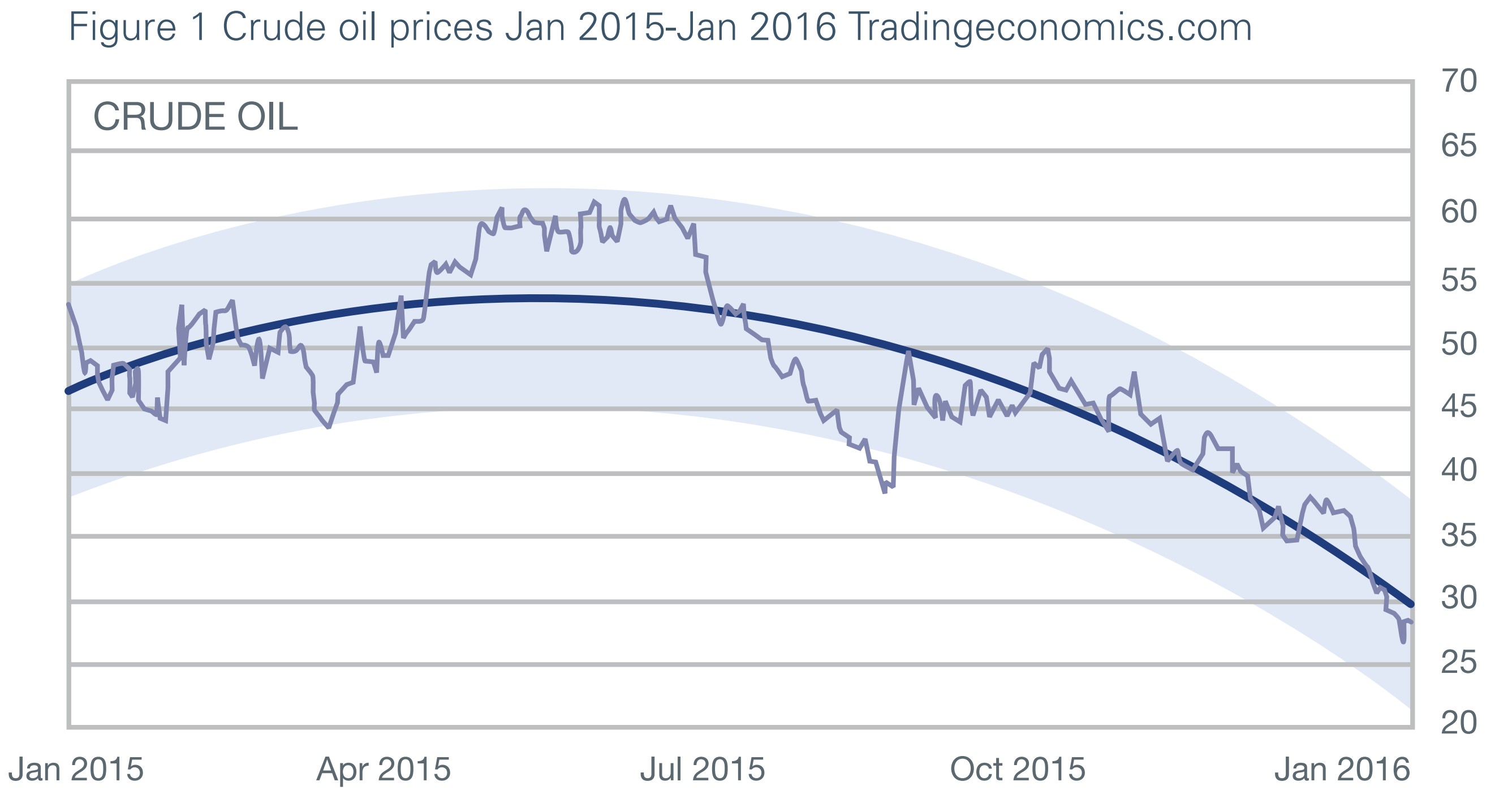

In the first weeks of 2016 oil prices plunged to below $30/ barrel with many analysts predicting that they will continue to fall to below $20/barrel. With an estimated 600,000bpd of Iranian oil poised to flood an already over-supplied market, we’re unlikely to see any significant change to this situation in the short to medium term. Facing dramatic budget pressures in their domestic economies, many oil-producing countries around the world are offering significant discounts to refiners in order to maintain the market share and cash flows necessary for domestic political and economic stability.

2. Internationally sourced crude has become more cost competitive

Secondly, from a crude supply logistics standpoint, we are witnessing one of the most attractive scenarios in North American refining history. The market has evolved and refiners have the option to buy cost-advantaged crude grades from suppliers anywhere in the world, while also keeping efficient options for domestic crude sourcing on the table.

This flexibility can positively impact refiners’ margins through reduced logistics costs as well as optimizing the product slate based on local equipment and complexity. With domestic and internationally sourced crude both having economically attractive characteristics, refiners need to know how to act swiftly and decisively to tap into the options provided by the market. This means that established crude logistics strategies that are primarily focused on domestic rail and pipeline transportation are no longer the only options.

Now is the time, but it’s not all plain sailing

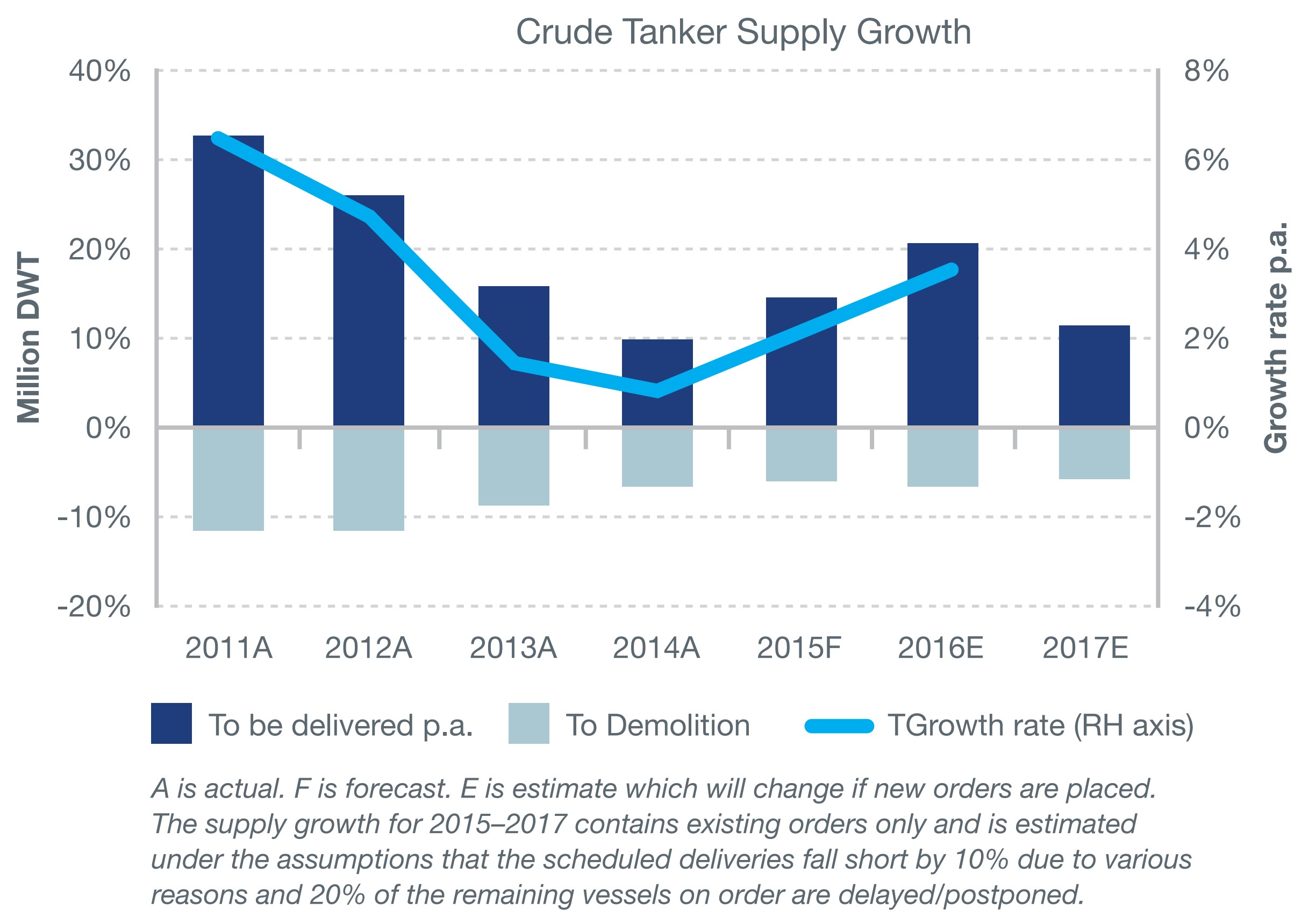

Shipping rates have increased over the years with costs for both crude oil and oil products tankers going from strength to strength.

Douglas J Mavrinac, Managing Director at Jeffries and Company said, “With the significant majority of crude oil being exported, we believe crude oil tanker demand should remain strong for the foreseeable future and likely increase with increased Iranian export volumes in 2016. Consequently, and with minimal new crude oil tankers being delivered from global shipyards through 2016, we believe the crude oil tanker market should enjoy further strengthening through 2016.”

As demand for crude tankers continues to outstrip the supply of available tonnage, navigating your way through the global crude supply market requires a level of expertise which many refiners lack the in-house capabilities to deliver.

So where do you go from here?

4 key questions refinery executives should be asking

In the current environment it’s survival of the quickest. The most successful businesses are the ones that are asking themselves the right questions and know where to go to find the answers fast.

These include:

1. Is my current crude supply logistics strategy best supporting my business targets and objectives?

It’s time for a re-evaluation of your logistics. In our experience, even organizations that are utilizing maritime shipping may still be able

to see significant EBITDA improvements through optimization. For example, are you utilizing possible voyage triangulations and backhaul options to obtain freight cost savings in the areas where crude oil is sourced? Are you optimizing the best vessel size availabilities to achieve economies of scale? Have you examined offshore lightering options, load co-shares and barging?

2. How can I maximize margins by sourcing the cheapest crude from around the world that runs the best through my refinery?

Apart from the obvious savings and margin improvements, it is essential for the viability of a refining operation to always be able to source the most competitive grades of crude in order to compete in the finished products markets. Many refiners are realizing that they obtain the best yields by blending different grades of crude, synthetic crude and condensates from multiple supply sources. In many cases, to obtain these grades they need to be shipped from overseas locations, e.g. Venezuelan synthetic crude and Algerian Saharan Blend and Condensate.

3. Am I taking full advantage of the global market via maritime shipping/barging and how should it be optimized with my other intermodal solutions?

Crude-by-rail and pipeline deliveries will continue to be an important aspect of crude supply logistics for many North American refineries. But, with market volatility over the past 18-24 months, it is now up to executives to ensure they are putting all logistics options on the table to create competitive advantage.

4. Do I have the right in-house resources to evaluate my right-now options and act fast?

In order to take advantage of the opportunity on offer, a refiner needs to ascertain that it has a professional Marine Department which is fully optimized to handle vessel chartering, operations and intermodal logistics, plus an Oil Trading Department with the capacity to scout the markets on a daily basis for the best advantage-cost feedstocks. Few people in the oil industry would disagree that there are difficult times ahead, but refineries that act now to optimize their logistics will be able to tap into significant EBITDA opportunities.