Private Equity 2020: Driving Value Creation in an Uncertain World

Contents

- Executive summary

- Private equity market dynamics across North America, Europe and Asia

- Unlocking the hidden value across the integrated end-to-end supply chain; growth cost and cash flow

- The timing of supply chain and operational improvements across the investment lifecycle

- Driving growth in conjunction with cost and cash flow, measurable supply chain and operations value creation to increase multiples

- The digital imperative

- Human capital is the most important asset – leader and organization improvement

- Conclusion

At A Glance

- Record levels of private equity capital in 2020 chasing a limited supply of attractive targets continues to foster a highly competitive deal environment

- Global risk factors and supply chain vulnerability increasingly create significant operational execution challenges

- Private equity firms are more involved with operational considerations for value enhancement

- Smarter due diligence is a critical success factor to uncover supply chain and operations-oriented economic value creation opportunities and drive successful business integration

- While many companies plan to invest up to 5% of annual revenue on digitization over the next five years, only one in 50 digital transformation programs has a measurable business case, according to GSCI research

- The PE world is waking up to the power of integrated end-to-end digital supply chain optimization to unlock shareholder value (cost, cash, growth) and improve competitiveness

- Aligning portfolio company executive leadership with middle management all the way to shop floor production staff is vital to driving measurable and sustainable change

- Portfolio companies need to have integrated, optimized supply chains and operations with enough optionality and resilience built in to mitigate risk factors and drive value across the different stages of the deal

- According to the OECD interim economic assessment, annual global GDP growth is projected to drop to 2.4% in 2020 as a whole.

1. Executive summary

The acquisitions market remains highly competitive, with a record level of unspent private equity capital (according to Bloomberg Economics). With private equity firms poised and ready to pounce we are seeing PE ownership increasing and becoming more mainstream. However, the fact remains that over 60% of acquisitions are still made by corporations.

In addition to robust buy-side activity, conditions outside of portfolio company control have increased the volatility of expected returns. A 2020 Global Private Equity Outlook Survey conducted by MergerMarket concluded that geopolitical risk factors such as China’s economic slowdown, US- China trade wars, the coming US presidential election and Brexit are among the most significant challenges facing private equity today. In addition, economic growth is stuttering in many parts of the globe. Since that report was written the spread of coronavirus has intensified. Annual global GDP growth is projected to drop to 2.4% in 2020 as a whole, from an already weak 2.9% in 2019, with growth possibly even being negative in the first quarter of 2020 according to the OECD’s interim economic assessment (March 2). As a result, businesses will inevitably need to improve competitiveness through cost-out initiatives, and support growth via acquisition and consolidation.

These efforts will be complicated by the fact that many companies still operate in functional silos which hinder cost, synergy, growth and customer service opportunities. In this climate, the only winners will be those that drive measurable value by improving their acquisition, carve-out, integration and performance improvement approaches.

It is critical that PE firms entering into transactions consider geopolitical, industry and company-specific conditions in combination with a clear value creation strategy. With market multiples at an all-time

high and potential for a future lower-multiple environment, PE firms are more involved than ever in operational considerations. They must find new methods to drive growth, operational effectiveness, efficiency and reduce risk in portfolio companies given today’s deal prices are making it a reach to drive value even with bolt-on acquisitions.

The overabundance of capital, coupled with increased geopolitical and economic risk, threatens to push down investment returns. In response, PE firms need to adopt innovative strategies.

Today’s hyperconnected global supply chains are extremely vulnerable to a range of risk factors including geopolitical tensions, tariffs, transportation delays, natural and man-made disasters, cyberattacks, theft and unforeseen quality issues. Resilinc’s annual EventWatch Report revealed a 36% increase in overall global risks in 2018. The report cited uncertain geopolitical factors such as the US- China tariff war, Brexit and the threat of economic downturn as among the most costly and disruptive supply chain impacts going forward. In addition to these ongoing threats, the Chinese coronavirus outbreak underscores the volatility of global supply chains. These forces expose businesses to dangers including production and delivery disruptions, fluctuations in quality and uncertain order fulfillment; threats that can damage reputation and lessen competitive advantage.

With macroeconomic, geopolitical, business and environmental risks gaining pace, private equity and portfolio company executives need to be able to transform the global end-to-end supply chain to increase profitability and drive growth. Integrated end-to-end supply chain optimization has the power to unlock significant shareholder value (cost, cash, growth) to improve competitiveness.

Transformation, which includes factors like re-evaluating manufacturing footprint and supplier optionality, looking more closely at shipping modes, and building a culture of collaboration between all stakeholders, has the power to unlock significant shareholder growth, but the critical enabler is undoubtedly digitalization.

From a digital perspective, many companies are planning to invest up to 5% of annual revenue on digitization over the next five years. However, many executives still remain uncertain of the benefits given only one in 50 digital transformation programs have a measurable ROI business case*.

Executives need to develop a clear business case, articulate a pragmatic digital roadmap and spearhead cultural change. These are critical success factors in driving the implementation journey.

Many industries are facing a period of rapid adjustment. Private equity owners need to ask themselves: How many of my portfolio companies have integrated, optimized supply chains and operations with enough optionality and resilience built in to mitigate risk factors and drive value across the different stages of the deal?

2. Private equity market dynamics across North America, Europe & Asia

Global

Valuation multiples are at their highest levels ever and there’s considerable competition among PE firms to find and acquire those elusive “diamonds in the rough.” Firms, led by Blackstone Group and Carlyle Group, have amassed almost $1.5 trillion in unspent capital, the highest year-end total on record, according to data compiled by Preqin. While last year saw roughly $740 Bn worth of private equity merger and acquisition transactions in the US and 465 Bn in Europe, this year could see deal making hit a level we haven’t seen since the economic downturn. Across all areas of the market, asset prices have risen and returns have often suffered as a result. The short-term impact of the coronavirus on global markets should not be underestimated, with much depending on the speed of economic recovery. To succeed in this hyper-competitive, unpredictable market, private equity firms must continually increase the robustness in their buying decisions, have a more validated investment thesis and faster value creation process.

North America

Although the US PE market in 2019 did not surpass the numbers registered in 2018, the level of deal activity remained robust with over 5,100 deals valued at more than $675 Bn. With uncertainty fueled by economic and political events such as the US-China trade war and the impending US presidential elections, the US PE market is bracing for a downturn. Despite many analysts believing the next recession is on the horizon, US PE firms have been rapidly raising an all-time high of $300 Bn of new funds. To compound the situation, many institutional investors were raising allocation to PE, and hedge funds were raising funds for buyouts. As examples, Elliott Management raised $2 Bn and the quant hedge fund, Two Sigma, raised $1.2 Bn specifically for buyouts.

The combination of recessionary fears, cash on hand that needs to be deployed, falling PE exit activity and elevated multiples has made the PE landscape a challenging and competitive environment for general partners (GPs). In these conditions GPs are forced to hunt more broadly and increase their commitment for the deals they seriously target. To generate an EBITDA lift, innovative firms are deploying fresh approaches such as addressing supply chain capacity and capability challenges to realize operational improvements. GPs and CEOs of portfolio companies are starting to recognize that accelerating measurable improvements across the plan-buy-make-move-fulfill supply chain to eliminate functional boundaries and deliver the greatest value to customers at the lowest cost to business is the way to go.

Europe

European private equity firms spent a record amount last year, deploying $190bn, up 29% from 2018, according to data provider Preqin. A decisive UK election victory for the Conservative party at the end of 2019 meant the markets could finally see an end to the long-running Brexit saga. However, multiples remain high and there are concerns that an economic downturn may be on the horizon. Post-Brexit, there is still a great deal of uncertainty about whether UK-based firms will face additional burdens on future fund raising in EU countries.

Faced with so much uncertainty, European PE firms have increasingly sought creative solutions to meet changing investor priorities under highly-competitive conditions. Many of the standout deals of last year exemplify the biggest trends, from diversification of portfolios to take-privates to corporate carve-outs. In the year ahead, whatever the outcome of trade negotiations between the UK and EU, it is clear that private equity firms will need to adjust their investment strategies. Expect to see a shift in focus towards the industries which are least likely to be affected, such as pharmaceuticals and other critical product and services.

Asia

As of the third quarter of 2019, private equity firms in Asia had over $350B in dry powder, according to Preqin. Deal making involving Japanese companies continues to trend upwards, especially with major Japanese pension funds increasing their allocations to alternatives. KKR, Carlyle, Blackstone and Bain are looking to capitalize on the relatively low PE penetration of the Japanese market by investing in teams dedicated to the region (PitchBook 4Q 2019 Analyst Note).

The US-China phase one trade deal signed in January 2020, eased some tension and uncertainty related to private equity investment opportunities in China. However, major players such as KKR and Warburg Pincus were continuing to raise funds to invest in Asia long before this trade deal. Warburg Pincus’ $14.8B Global Growth fund, which closed in December 2018, has a broader mandate to invest globally and across sectors, while its $4.25B China-Southeast Asia fund, which closed in January 2019, targets investments in Chinese and Southeast Asian portfolio companies. KKR’s fourth Asia fund is targeting a $12.5B close in 2020 with investment plans in Japan, China and India. While competition from Baidu, Alibaba, Tencent and state-owned entities is an ongoing risk for PE investors in China, Chinese government forced divestitures may create opportunities for PE investors. In addition, incidences such as the Chinese coronavirus outbreak underscore the risk of direct economic impact on supply chains across the globe. The 2003 SARS outbreak reduced China’s real GDP by 1.05% (Lee & McKibbin, Brookings Institution, Moody’s). A recent Moody’s forecast estimates that coronavirus will cut in excess of 2% from Chinese real GDP growth at an annualized rate in the first quarter of this year (moodys.com 02/04/2020). Decreased Chinese economic activity will likely reduce global manufacturing output. The longer the outbreak, the greater the impact on portfolio companies and consequently PE investments across the globe.

3. Unlocking the hidden value across the integrated end-to-end supply chain; growth, cost and cash flow

Given the notoriety over the last ten years surrounding supply chain excellence of companies like Apple, Unilever, Amazon, McDonald’s, P&G, etc., the wider investment community has slowly realized that shareholder value runs through supply chain performance. Unfortunately, this concept is not fully internalized and remains an untapped opportunity in many firms.

With the end-to-end supply chain: procurement (buy), operations (make), logistics (move & fulfill) representing approximately 80% of the cost and working capital base of a typical company*, the PE world has only recently started to wake up to the significant opportunity to unlock value across the integrated supply chain. The question is: What are you doing about it to drive measurable value?

So why do the stock analysts, and more importantly private equity firms, care about a firm’s supply chain excellence? First, though supply chain and operations excellence often dramatically reduces product costs, cost-cutting is not the only motivator. Outstanding integrated supply chain performance drives value creation, increases customer experience and enhances growth because it controls the heartbeat of the firm. The fundamental flow of materials is most efficient with information linking suppliers through the firm all the way to its customers. Unfortunately, too many companies have a supply chain crippled by lack of strategy around technology, not having the right talent to interpret and utilize operational and supplier data, internal and external silos and a basic lack of discipline in managing the end-to-end supply chain.

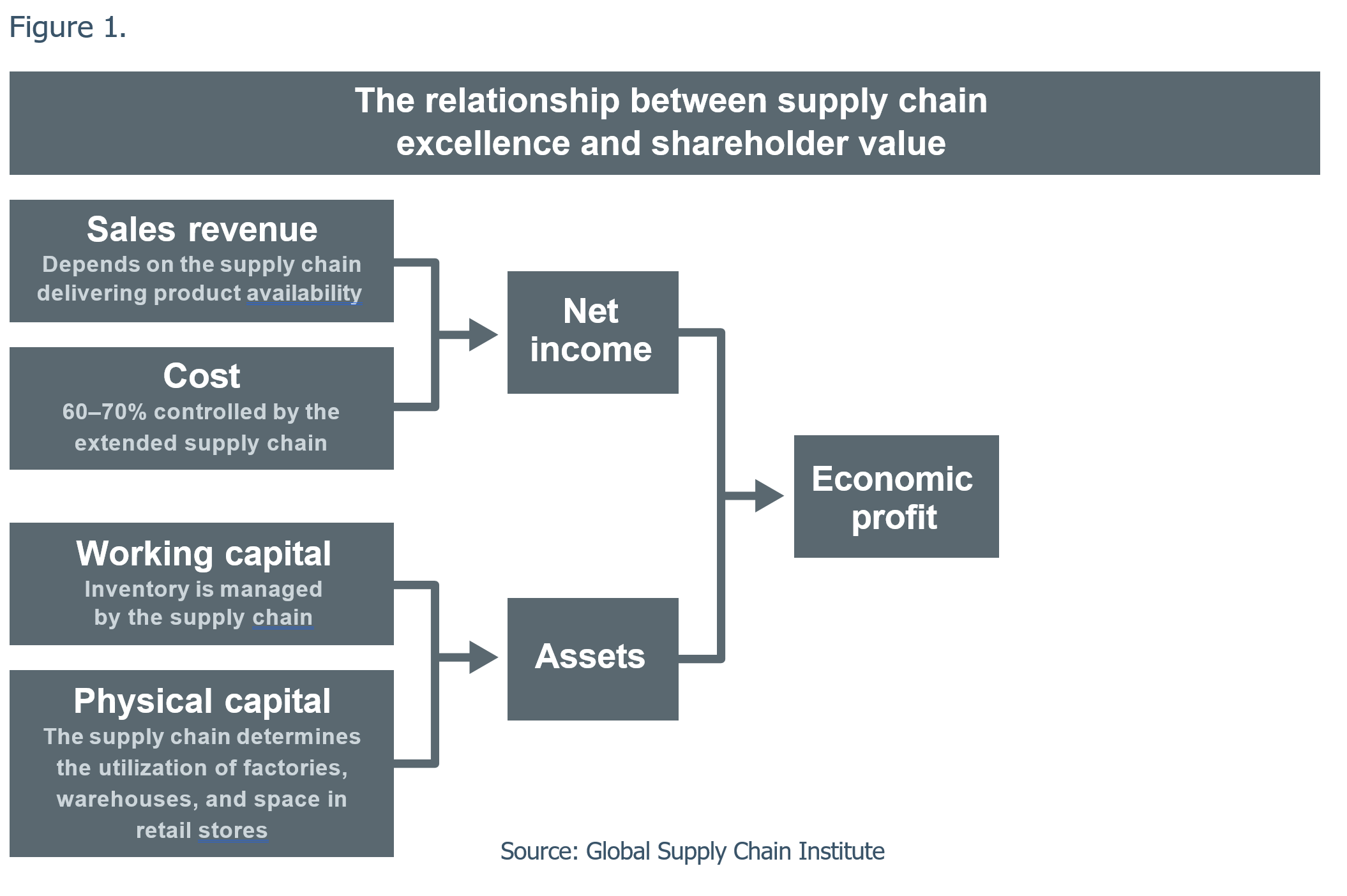

Linking supply chain optimization to value creation and shareholder value

In collaboration with the Global Supply Chain Institute, Maine Pointe co-authored a paper for CEOs called Driving Shareholder Value with Your Supply Chain. The paper outlines how world-class supply chains create economic profit when they:

- Support higher revenue by providing flawless delivery to customers thereby enabling growth

- Reduce cost by ever more efficient operations

- Reduce capital requirements with lower inventory, lower overall working capital, and streamlined physical networks.

Cost, cash and growth

Many market leading companies are close to getting it right. However, what about the market followers? How can they catch up and drive measurable value?

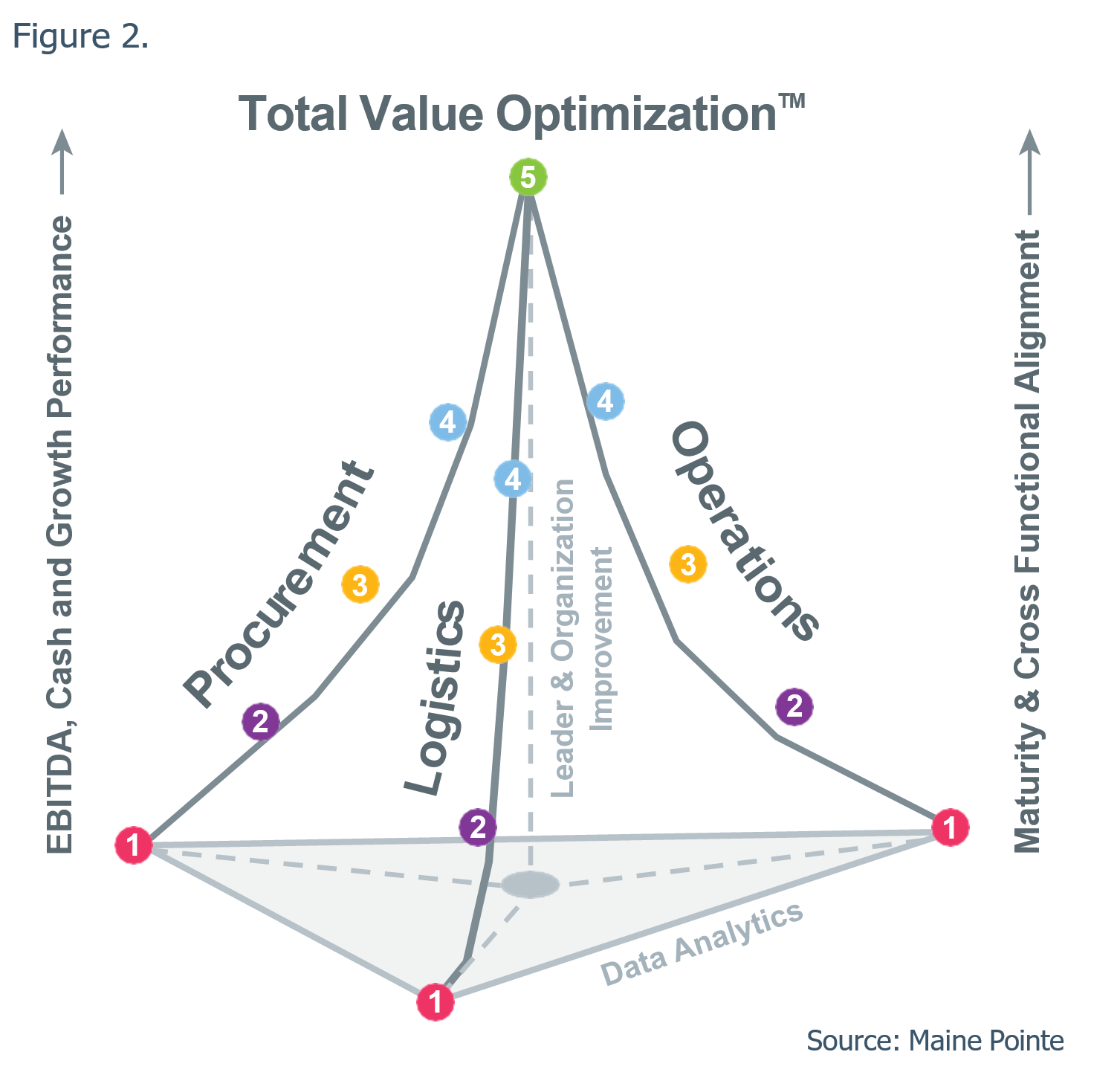

The Global Supply Chain Institute’s Shareholder Value paper outlined how Maine Pointe’s Total Value Optimization (TVO) framework, pictured in the graphic in Figure 2, focuses on finding the value drivers for cost, cash and growth and then constructing an action plan to achieve them by leveraging the end-to-end supply chain. It also cites an earlier Maine Pointe survey of 50 private equity firm executives who work with companies to improve financial results. Supply chain functions such as logistics, operations, and procurement were surprisingly ranked by many firms as “relatively unimportant” in driving cash and growth. This indicates a significant lack of understanding regarding the critical importance of the supply chain in these areas. Many organizations rank low on the maturity curve with respect to supply chains’ impact on financials and haven’t honestly faced the gap in their performance versus world-class. (For a detailed analysis, see Maine Pointe’s CEO, Steve Bowen’s book Total Value Optimization – Transforming Your Supply Chain into a Competitive Weapon. Boston: Maine Pointe, 2017).

Effective supply chain management drives enterprise cross-functional integration to produce the highest availability with the minimum cost and capital investment. This increases economic profit because it supports higher revenue at lower costs and with lower working capital; in other words, a focus on cost, cash, and growth. An increase in economic profit supports an increase in value creation or shareholder value.

4. The timing of supply chain and operational improvements across the investment lifecycle

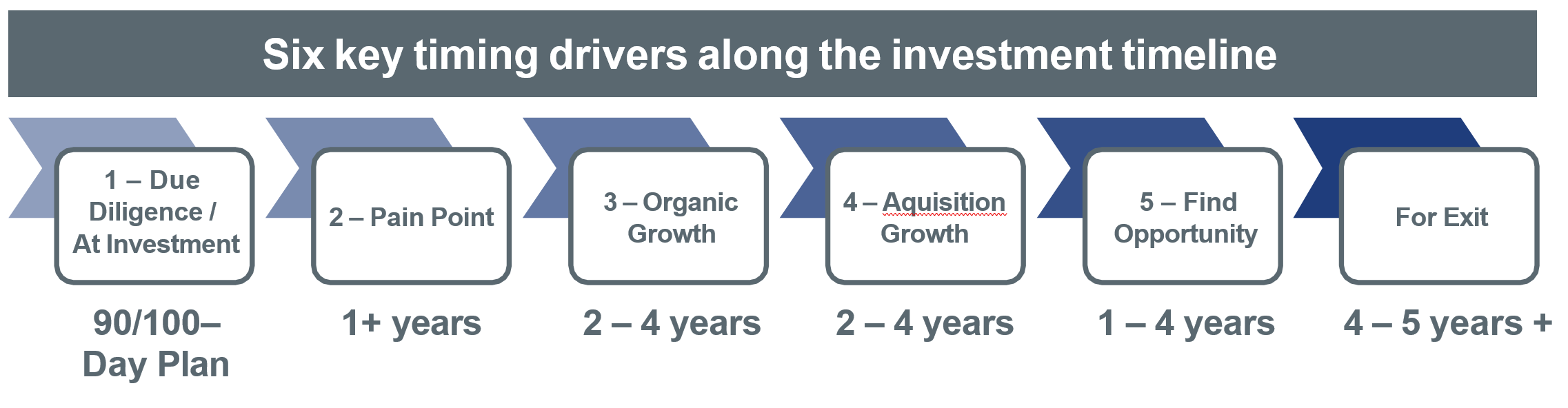

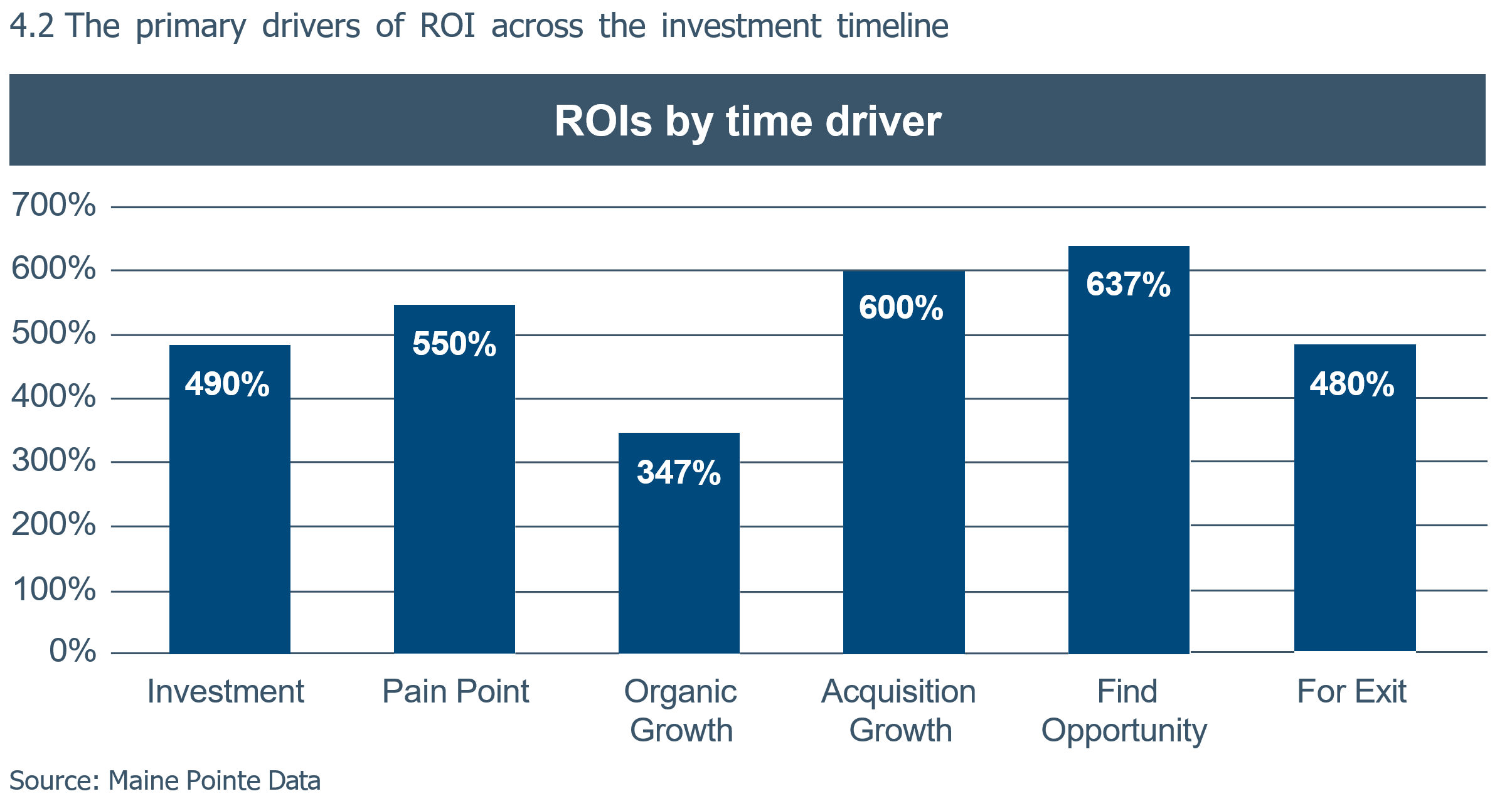

With operating improvements firmly ensconced in the minds of all stakeholders, and many settling on the operating model that works for them, the question becomes: When is the right time to make supply chain and operating changes? Maine Pointe’s research identified six key timing drivers where circumstances drive the potential for operating value creation.

The timing triggers analysis shows that all six points are viable to consider for a call-to-action, with good ROIs across the board when external resources are used.

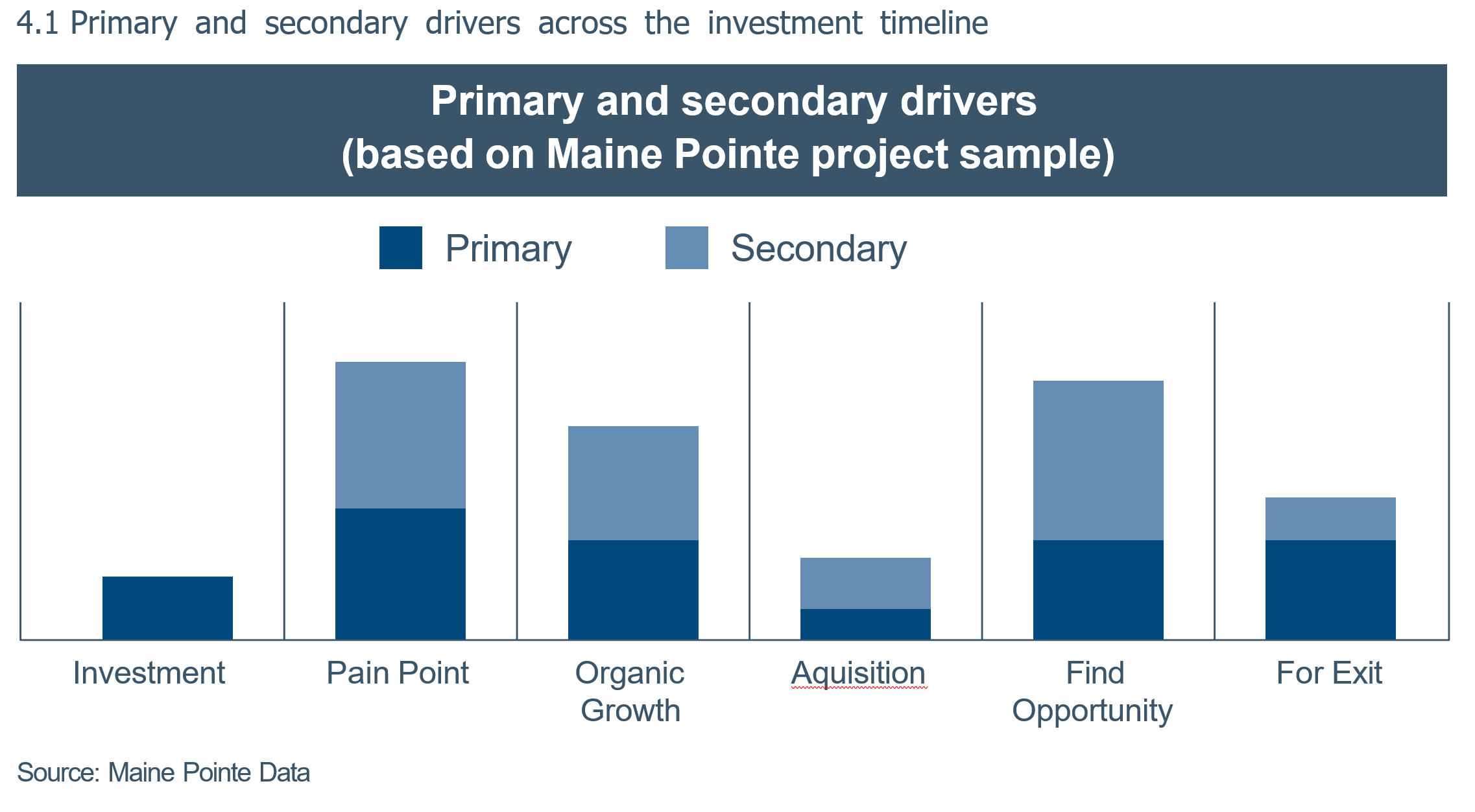

Based on the above definition of the six timing drivers for making significant operating improvements, Maine Pointe analyzed a sample of 40 projects conducted on behalf of private equity firms and their portfolio companies. Our goal was to understand which drivers were most prevalent, when in the investment lifecycle those drivers initiated engagements, and what the typical results looked like.

The projects analyzed were unanimous in selecting investment as a primary driver. However, for the remaining five triggers we saw a much more even split between primary and secondary drivers, with finding opportunity more commonly seen as secondary and preparing for exit more likely to be primary.

Findings: Any of the timing drivers are viable entry points for external assistance. Pain points, or a desire to find opportunities across the company, are the most common. The amount of interventions preparing for exit is significant and has been trending higher as valuations remain high.

With all stakeholders placing an increasing value on operating and supply chain improvements, private equity firms must look towards all the variables in how they operate and provide value creation support. These options include a variety of operating models, the selection of internal approaches or external implementation partners, and the timing triggers for taking action.

The timing triggers analysis shows that all six points are viable considerations for a call-to-action, with good ROIs across the board when external resources are used. Some of the most common historical intervention points, such as the initial 90-day plan, are matched, or exceeded, by some of the least common intervention points. For example, conducting an external review after years of investment without an identified pain point.

As private equity investment leadership and operating partners examine their investment portfolio, this model may provide a different way of considering when major interventions may produce value.

5. Driving growth in conjunction with cost and cash flow, measurable supply chain and operations value creation to increase multiples

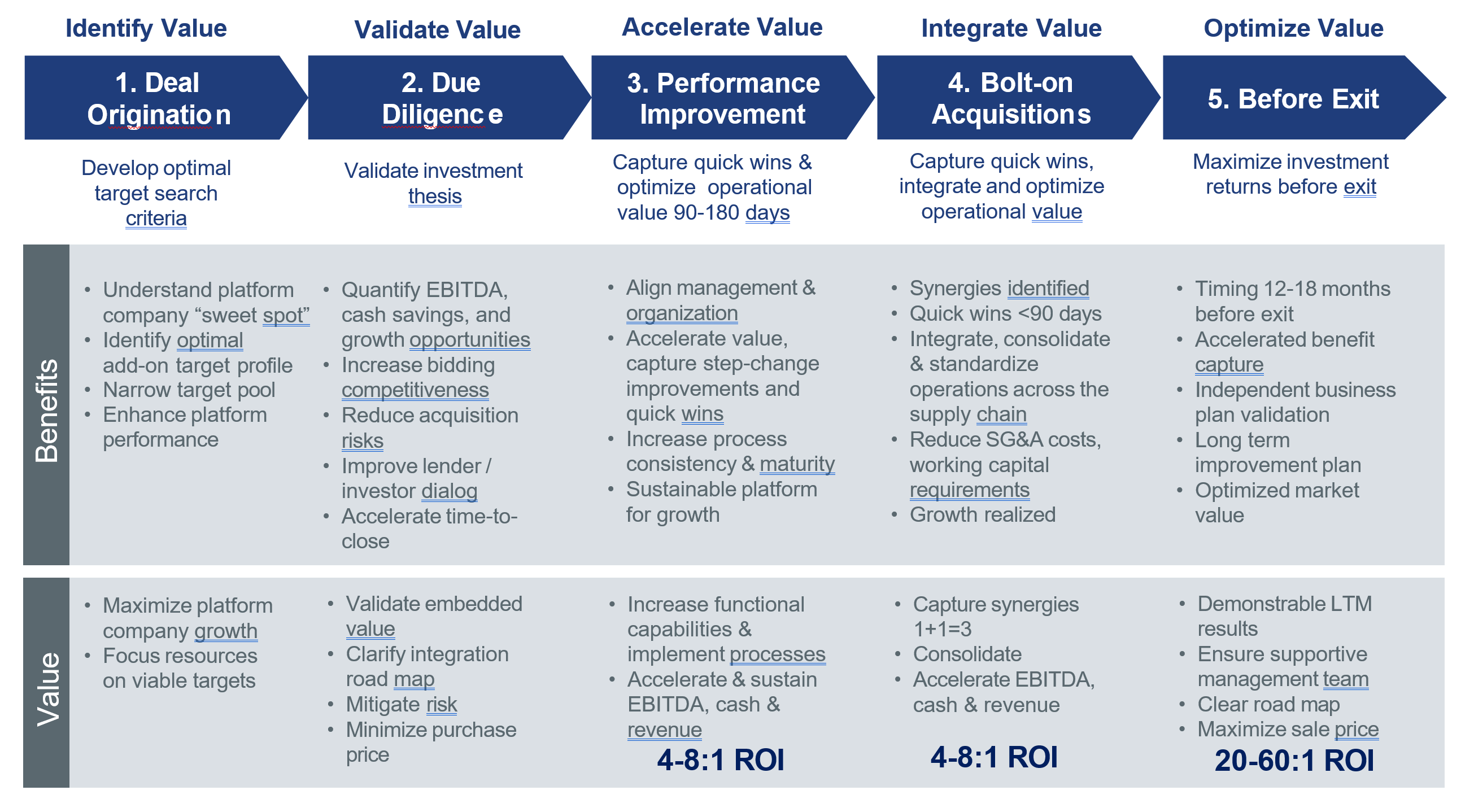

Given the six timing drivers outlined above, it is important that deal and operating partners understand how to drive measurable and sustainable value across the deal lifecycle in order to stay ahead of the pack regarding deal confidence, competitiveness and time-to-value creation.

When it comes to driving measurable value, we outline below how Maine Pointe, having worked with over 50 private equity firms around the world, drives measurable, quantifiable value across the following five domains of value.

Deal Lifecycle: Typically ~ 3-5 years

5.1 Deal origination

Identifying the ideal target candidates for your platform, understanding how targets fit into your buy and build strategy and how targets can fill operational and talent gaps are crucial to value creation. Whether you are working internally or with a partner like Maine Pointe, it is important that teams understand your platform business and goals and can identify the value levers for bolt-ons in your niche. This allows you to accelerate your hunting phase and focus on the work to close the transaction successfully.

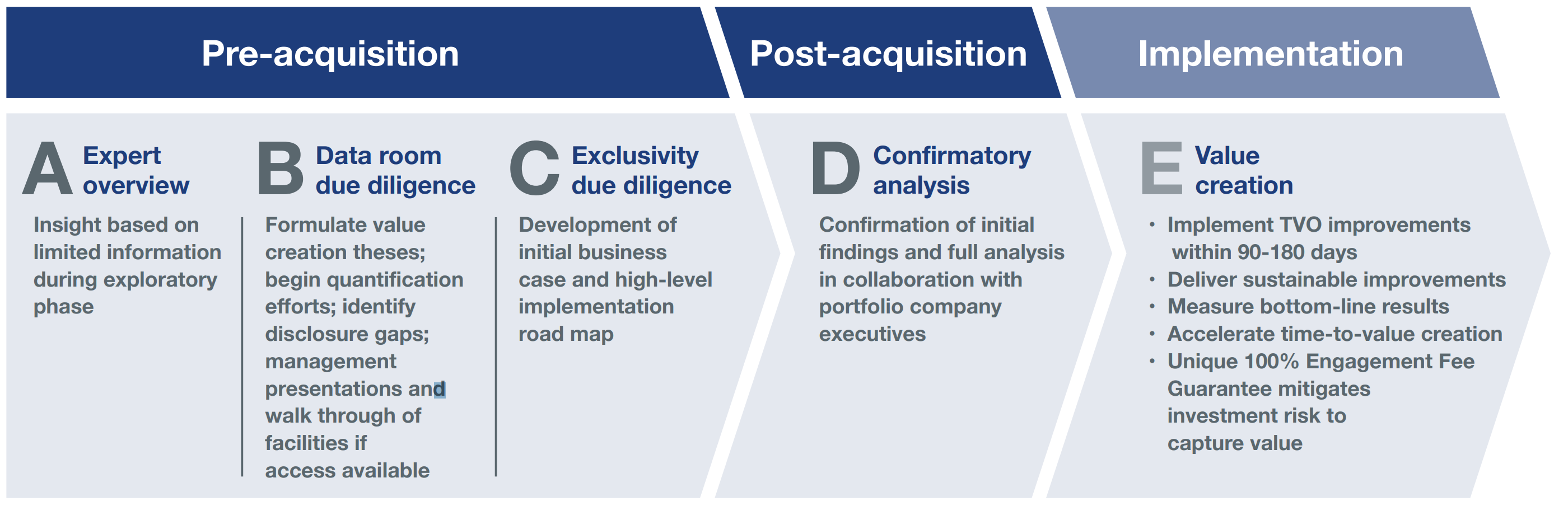

5.2 Due diligence – earlier is better – TVO operations due diligence

Understanding the supply chain and operational improvement thesis is critical to enhancing confidence, competitiveness and time-to-value-creation. If you don’t quantify and capitalize on the EBITDA, cash savings and growth opportunities in the supply chain and operations that can be identified at the due diligence phase, you are missing a trick. Taking a thorough approach to this helps deal partners increase their bidding competitiveness, reduce acquisition risks, improve lender/investor dialog, accelerate time-to-close and optimize the realization of value creation opportunities.

Due diligence should not be a stand-alone activity. It is just one part of a continuous process as the company transfers to new ownership. Due diligence should also provide the foundation for the post-closing integration plan, establishing a road map for the timing and resources needed to deliver the investment thesis. Furthermore, the experts supporting the operational and supply chain diligence are best positioned to support pre-closing activity, which is especially relevant for carve-out transactions with potential gaps in staffing and crucial institutional knowledge.

How due diligence should be integrated into the value creation process

5.3 Performance improvement

Post-acquisition it is important you work to align management and the organization, to drive quick wins (<90 days) and sustain step-change improvements across procurement, logistics, and operations. If you don’t have the internal operating capacity, you may need an external partner to help you drive measurable results and infuse best practices to establish an optimized platform for bolt-on growth.

5.4 Bolt-on acquisitions

Once you have established your operational platform, it is imperative to pursue, close and integrate acquisitions to enable growth. At this stage synergy savings, achieving quick wins (<90 days), then integrating, consolidating & standardizing operations across the supply chain are the order of the day.

The results are reduced working capital requirements and accelerated EBITDA, cash and growth.

5.5 Before exit

Many private equity firms only embark on an operational improvement initiative once. However, performance ‘leakage’ does occur. To maximize deal returns, many leading private equity firms bring in a specialist supply chain and operations consulting partner 9-18 months before exit. At this phase there is an opportunity to accelerate benefit capture through quick-win engagements and further optimize the portfolio company’s supply chain and operations, thereby increasing the sale price. At Maine Pointe, we help implement demonstrable LTM (last twelve months) results, support management and provide a clear road map for further improvement. One example of the effectiveness of this approach was a 60:1 ROI our engagement with a portfolio company delivered for the PE owner at exit in less than one year.

6. The digital imperative

As highlighted in the Maine Pointe TVO Pyramid earlier in this paper, (figure 2), data analytics and digital supply chain transformation are critical to future value creation.

On a global basis, every industry is impacted by the speed of change in the marketplace. While some technological changes are incremental, others are changing entire industries. Advancements in technology have vastly increased the speed at which decisions have to be made in order for firms (including PE firms) to win. Portfolio company executives need to evaluate vast amounts of relevant, up-to-date information. For positive decision-making, it is essential organizations pursue a data-capture and analysis strategy which delivers real-time visibility to managers and decision makers. Best-inclass companies utilize the vast information available within their own systems to produce interactive dashboards and scorecards for the leadership team. They then align behavior to the goals of the PE firm by linking compensation to the key value drivers whose results are reported by these systems. With many companies planning to invest up to 5% of annual revenue on digitization over the next five years, numerous PE firms and portfolio executives still remain uncertain of the benefits and only one in 50 digital transformation programs has a measurable ROI business case ( according to research form Global Supply Chain Institute, University of Tennessee). PE partners will need to ensure the CEOs of portfolio companies develop the business case, articulate a pragmatic roadmap and bringing about cultural change. These are critical success factors in driving the implementation and accelerated value creation journey.

Why do some digital supply chain and operations transformations fail?

It must be noted however that not all digital strategies produce the results businesses are hoping for. From our discussions with executives who have embarked on a digital supply chain transformation and research into why the projects succeed or fail, we have identified nine transformation challenges that need to be addressed before the initiative begins:

- Executives are unclear about the end-to-end supply chain investment case and implementation journey for their business

- There is insufficient CEO leadership/sponsorship, cultural alignment and budget

- Operations, procurement, logistics, sales, marketing & IT predominantly reside in silos with little collaboration across the enterprise

- Leadership is reluctant to change/reinvent the business model to accommodate change and disruptive technologies

- There is no cohesive, cross-organizational supply chain/digital vision and strategy

- Companies have a supply chain/technology talent/skills gap across the organization

- Legacy IT systems and culture are deeply entrenched, and there is resistance to change. The prevailing culture is risk averse, ‘why fix it if it isn’t broken?’

- Slow deployment of supply chain collaboration and new technologies means organizations are unable to show early wins to gain employee and stakeholder buy-in

- The digital strategy is viewed as a ‘technology fix’.

Where should our digital supply chain conversion start?

While every aspect of digital supply chain, including Industry 4.0 and smart operations, might not be essential to every business right away, the move cannot be put off. Making a business case for a digitally enabled supply chain may be a challenge, but the first, and most immediate, step is to conduct an analysis across the supply chain to identify use cases. The goal is to assess the maturity of the plan-buy-make-move-fulfill supply chain, taking a closer look at the company culture and leadership to determine what, if any, changes need to be made to roll out a digital supply chain program. Once that analysis is complete, a step-by-step implementation strategy, business case, and road map can be articulated based on where the company is today, and where it needs to be in the future.

Leveraging existing technical investments can often be a great place to begin, but make sure you have a strong ROI business case before getting started.

7. Human capital is the most important asset – leader and organization improvement

While technology is part of the value improvement formula for supply chain and operations business transformation, it is merely an enabler in portfolio companies. The collective might of having the right people, in the right place, with the appropriate mindset and with class-leading processes, is the key element for success and enhanced profitability.

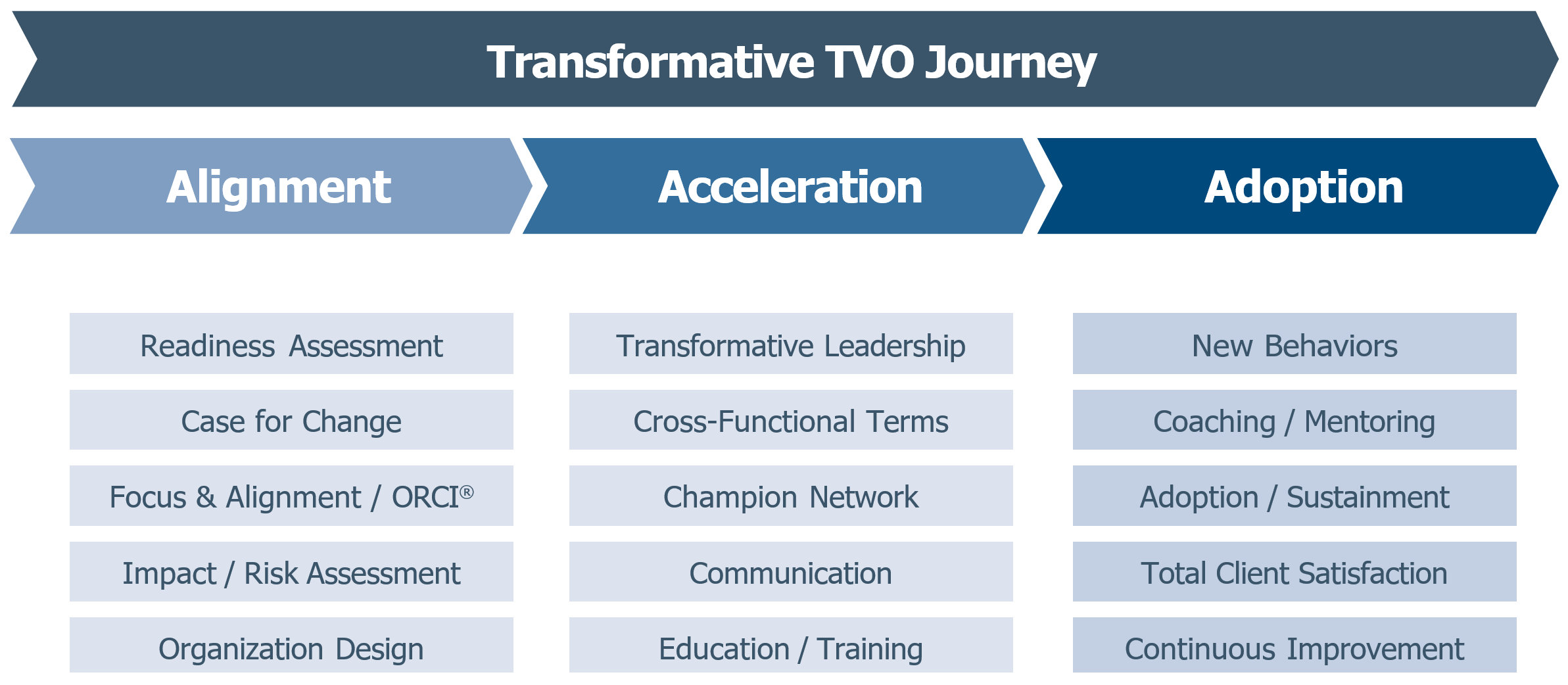

Aligning your executive leadership to your middle management and the shop floor is vital to driving measurable and sustainable change. That is why leader and organization improvement factors are critical to driving change and making it stick.

Failure to address the ‘emotional’ factors caused by ownership change and absence of a robust training package are common factors in low-return acquisitions and other failed transformation projects. Corporate renewal and transformation require much more than a routine checklist. Instead, an effective project plan includes a complete a set of activities. Transformation begins by instilling a “change mindset” within the employee base. Understand the process and cultural barriers to better performance from prior ownership. Properly engaged, the employee base is happy to share their views of roadblocks. The perceived roadblocks often line up with sub-standard performance in the affected area which is identified during diligence. Coupling the high-value and actionable roadblocks with the transition plan eases buy-in, in many cases, there must be a deliberate and planned approach to changing culture. Old habits are often not conducive to supply chain and operational improvement. Accelerated performance improvement can only happen when employees are willing to change. Having the existing employee pool improve to class leading performance is always faster and usually far less expensive the widespread talent replacement strategy.

When embarking on any change program, leader and organization improvement (LOI) initiatives align the business from the top to the shop floor and guide the organization through change to sustainment.

LOI introduces the transformation, guides client through the change and drives sustainment

To support alignment: Conducting organizational readiness and climate assessments using surveys and interviews is key.

This collection of data might also include client suppliers and customers to:

- Develop a case for change that can be broadly shared to help the organization understand the necessary transformation

- Conduct a focus & alignment session with client leaders to level-set everyone on the transformation initiative, how it fits into the vision/mission/values of the organization, and who owns what using the ORCI® methodology

- Help the cross-functional teams assess the impacts and risks of the changes they are proposing for implementation and help develop mitigation plans

-

When necessary, drive the design of the new organization needed to support the improved processes developed by the cross-functional teams

To support acceleration: Focus on developing the change leadership awareness and skills of client leaders, as well as change champions who are peer-to-peer leaders in their respective areas of the business. This ensures:

- A heavy focus on timely and effective communication and education/training to help stakeholders understand their new roles and responsibilities

- Behavior and cultural changes reinforced by redesigned recognition and where rewards are achieved

To support adoption and reinforce sustainment of the new ways of working: Coaching and mentoring must be deployed, many times through a train the trainer approach so it becomes part of the new organizational culture.

This involves:

- Assessing the level of adoption of the new ways of working through surveys, interviews and focus groups to identify what is going well and what needs more attention to ensure sustainment

- Working with the portfolio company team to assess Total Client Satisfaction, not just with the benefits numbers, but also with the organizational and cultural changes desired

- Setting the stage for a culture shift to drive continuous improvement and better prepare the business for changes that may be necessary in the future.

8. Conclusion

Notwithstanding continuing geopolitical uncertainties, the global private equity investment environment is set to remain highly competitive in the year ahead. While private equity started 2020 with a record level of cash to spend strategic buyers continue to win 60% of deals.

The overabundance of capital is leading to fierce bidding wars for hot targets, a circumstance which threatens to push down investment returns. To compete in this market, private equity firms need to adopt innovative strategies which drive value at pace. The PE world is beginning to wake up to the, often untapped, opportunity to unlock value within the end-to-end supply chain, and many companies are adopting a far more rigorous approach to portfolio company management and supply chain risk management. However, in today’s rapidly changing world, additional support may be needed to develop sharper, more agile processes and improvement programs across the investment lifecycle.