A 2-5% EBITDA Improvement Opportunity for U.S. Construction Industry

In this short Q&A, David Kleine, EVP Industrial Manufacturing and Services, and Steve Ottley, EVP Analysis provide their perspectives on current opportunities and challenges for the U.S. construction industry. They discuss how Maine Pointe helped one client unearth an additional 2-5% EBITDA improvement beyond current plan and how other industry executives can act on this opportunity right now.

With US construction booming, what stress is this putting on companies’ supply chains?

David Kleine: 2016 was a record-setting year for the construction industry with spending 4.5 times higher than in

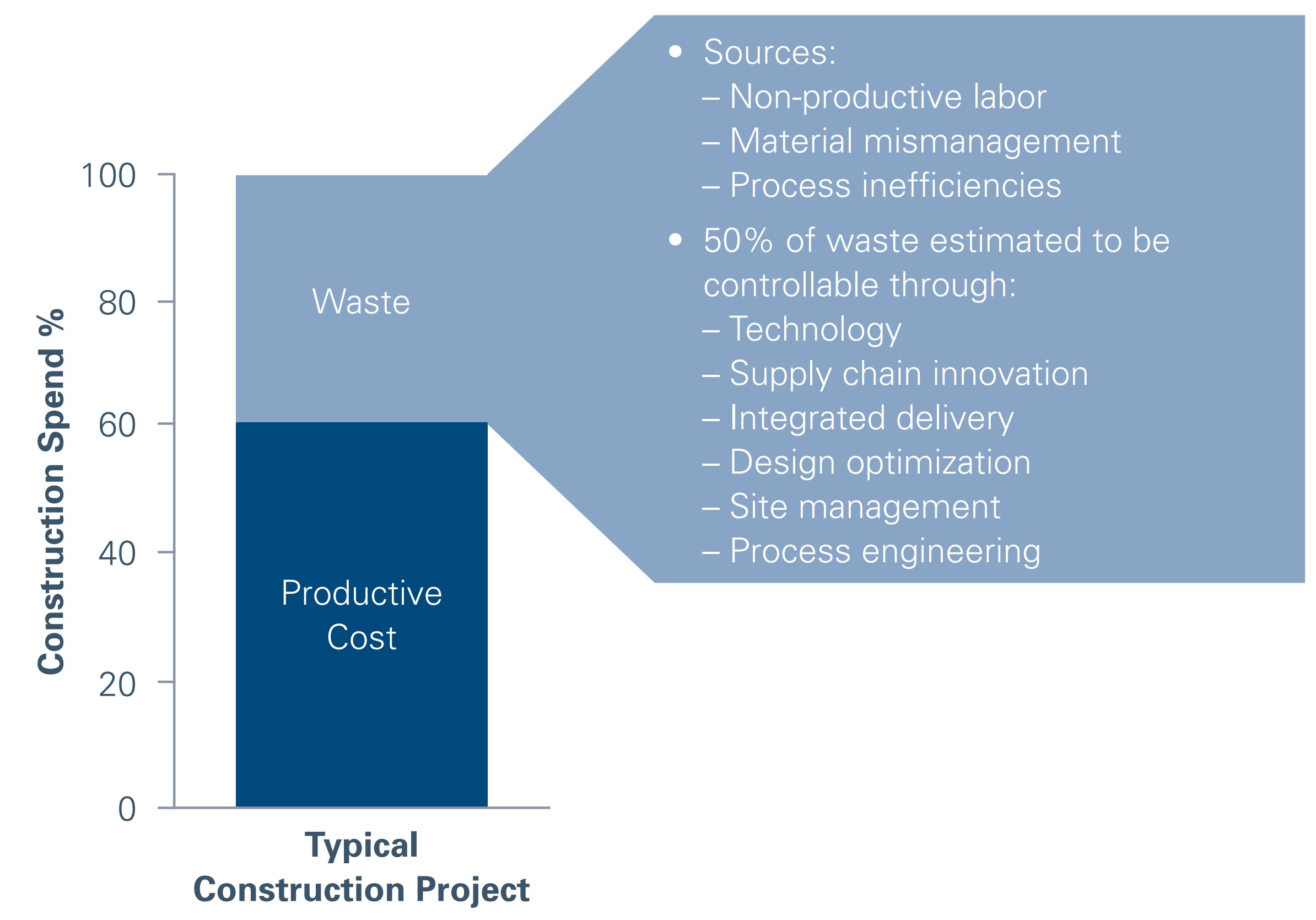

2015. As 2017 continues, we can expect policy decisions from the new administration to affect the way business is done. Immigration legislation, labor laws, international trade deals and tariffs, combined with a hesitant industry, make a significant impact almost certain. But we aren’t seeing it just yet. Right now, even the biggest players in the sector are facing some significant headwinds in the form of a shortage of skilled labor, low productivity, pricing volatility and stricter environmental and safety regulations. There is also a significant amount of waste (more than $120B annually) in US construction because of outof-control delays, cost overruns, and other inefficiencies. All of this is having a negative impact on many companies’ ability to meet demand, while hitting corporate profitability.

The key to remaining competitive lies in taking a fresh look across the company’s buy-make-move-fulfill supply chain. There are two meaningful opportunities for organizations to improve their value proposition and differentiate themselves to clients:

- The elimination of waste and inefficiency (zero waste)

- Offering a superior service proposition.

How can senior executives ensure that they have an efficient supply chain that is capable of capturing growth and profitability improvement opportunities?

Steve Ottley: This is a question that vexes many of the senior executives who we meet. Construction supply chain management offers a new approach to reducing costs and increasing reliability and speed. The trick is to have an end-to-end view of your value chain to identify and drive execution to reduce inefficiencies and waste. Many organizations recognize the need for this, but few have the internal capabilities to carry out a full analysis on their current logistics, site operations, subcontractor selection/management and procurement functions.

One of the greatest opportunities for creating value and differentiation is in reducing the waste and inefficiency in project delivery – valued at 20%-40% of project cost.

The construction industry isn’t shy of good ideas. For example, the LEAN construction institute has been around for many years training members in improvement techniques. The challenge is following through on implementation and consistent execution across sites. For many companies, the answer is to seek out partners who can help them take advantage of innovation to drive step-change improvements in value.

How can construction firms optimize their existing supply chain to maximize margin?

David Kleine: Let me give you an example. We worked with a large global construction firm that was rapidly losing its market

share. The company was struggling to ensure that its supply chain was able to re-capture market share while meeting shareholder demands for margin improvement. Our analysis found that completed margins were highly variable across divisions and categories, site management was ‘passive’ and focused on day-to-day problem solving rather than financial margin leakage. We identified that there were opportunities across the buy-make-move-fulfill supply chain totaling between $100M-$179M. We identified significant savings opportunities in operational excellence (lean construction), project profitability and margin management & sales conversion.

This was something their in-house team was too busy to identify and capture.

To help CEOs quickly assess whether they may have operational improvement opportunities in their business. What should they ask?

Steve Ottley: There are some simple questions that I would urge all construction industry CEOs to ask themselves:

- Do I have a consistent controls and processes across

my project sites? - Am I fully leveraging strategic procurement to increase

my margins? - Is my project acquisition process getting me profitable

business with minimal risk?

If the answer to any, or all of these questions is ‘probably not’, you may be missing out on some significant savings opportunities within your operations.

Many construction executives are under pressure and simply don’t have the time for another major corporate initiative. What is your advice to them?

David Kleine: CEOs in the construction sector are being asked to deliver larger, more complex, multi-disciplinary projects for clients in the public and private sectors as well as smaller special projects. With an immense range of items competing for their attention, it’s not surprising that they are wary of committing themselves to another ‘big bang’ initiative. However, it is possible to take a more pragmatic, step-by-step approach to execute on a competitive strategy. Setting out a personalized journey map that allows you to achieve your stakeholder and value targets at a pace driven by you.

The focus is on aligning leader and operational teams with strategic goals, enhancing internal and external teams/processes and behaviors to deliver sustainable improvements. In our experience, as companies drive synergy, savings and an on-demand customer service, they find that their logistics, procurement and site operations excellence become increasingly interdependent and less siloed. The end result is a synchronized buy-make-move-fulfill supply chain capable of delivering the greatest value to customers and investors at the lowest cost to business. This is encapsulated in our Total Value Optimization™ (TVO) approach.

How can executives quickly assess whether they have the in-house resource to mitigate the risks and capitalize on this opportunity?

Steve Ottley: It’s critical that clients are able to frankly assess their own capabilities and ascertain whether or not they have internal hands-on specialists that can analyze and implement changes to capture value. To do this, we ask executives to answer the following questions.

- Do we have the skills and capacity to identify and quantify

the real opportunity? - Do we need external help to identify our own constraints and

to help us to break through functional barriers and silos? - Do we have the internal capabilities to create a robust and

measurable business case with a clear ROI and deliver

against it on time, on target, and on budget? - Do we have the change management skills to enhance our

internal teams and deliver sustainable performance?

Then, there’s one final question they might want to consider:

- What is it worth to our company to accelerate improved results (e.g., what if we could get to benefits in 9-12 months with external help vs. 3-4 years on our own)?

If you would like to talk through this, or any of the points raised in this article, contact us for a no-obligation discussion.