Energy Transitions Are Complex, Costly, and Essential

The GHG Protocol Commits Companies to Strive for Net Zero

The greenhouse gas (GHG) protocol sets guidelines and requirements for companies in calculating, and then reducing, their corporate carbon footprint. Those guidelines can be difficult to implement and manage unless you understand the differences, risks, and incentives for reducing carbon emission under of the protocol.

Launched in 1998, the GHG Protocol is the global standard framework for measuring and managing greenhouse gas emissions from private and public sector operations, value chains, and mitigation actions. The World Resources Institute and the World Business Council for Sustainable Development joined forces to create the GHG Protocol. They established accounting standards, tools, and training to help businesses to measure and manage climate-warming emissions.

The three scopes of emissions control increase in difficulty and complexity

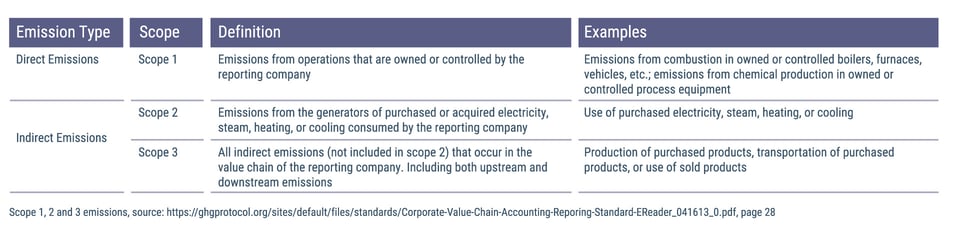

The protocol establishing three scopes of emissions and emission sources that should be controlled. Scope 1 emissions are the simplest; Scope 3 are the most complex.- Scope 1 emissions are direct emissions; they come from sources that the company owns or controls. The on-site generation of emissions comes from the use of natural gas and fuel, refrigerants, combustion in owned or controlled boilers and furnaces, and fleet vehicles (e. g., cars, vans, trucks, aircraft). Scope 1 also encompasses emissions released during industrial processes, and on-site manufacturing (e.g., factory fumes and chemicals).

- Scope 2 emissions are indirect emissions; that is, greenhouse gas that comes from the generation of purchased or acquired energy (electricity, steam, heat, or cooling) that is generated off-site and consumed by the reporting company. For example, electricity purchased from the utility company is generated offsite, so it is considered an indirect emission. Scope 3 also includes all indirect emissions that occur in the value chain of a reporting company.

- Scope 3 emissions include emissions from a company’s customers, suppliers, and suppliers’ suppliers—in other words, throughout the entire end-to-end value chain. The US Environmental Protection Agency (EPA) describes the Scope 3 emissions as “the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly impacts in its value chain.” These indirect emissions may represent the largest portion of a reporting company’s emissions even though they are out of the company’s control.

Overview of the scopes

Ramping up to meet net zero is costly

Achieving reductions on the scale required by the CHG protocol requires commercial investment on a massive global scale estimated at $100 billion to $150 billion per year from now to 2050. Commercial organizations alone cannot fund these investments so help is need from international governments and regulatory bodies.

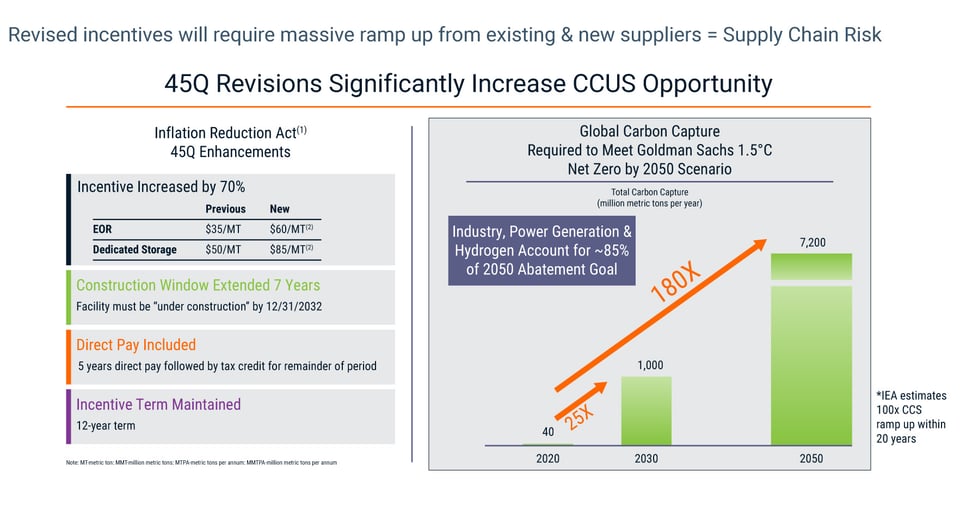

Within the US, the recently announced Inflation Reduction Act offers significant incentives for CCUS projects as outlined below.

Risk & Reward

Carbon capture, usage, and storage entails financial and technology risks

To put into context the scale of the carbon capture problem, based on the current pipeline for carbon capture, usage, and storage (CCUS) projects, approximately 110 million tons per annum (MTPA) of CO₂ are expected to be captured annually by 2030. On a global scale, to achieve the net-zero commitments pledged by 64 governments at COP26, approximately 715 MTPA must be captured by 2030 and 4,200 MTPA by 2050. Recent IEAA research suggests this would require a 10,000% ramp up in CCUS projects by 2025, while Goldman Sachs estimates a 180,000% ramp up will be required by 2050.

Reaching Scope 2 and 3 carbon reductions will require a whole new, unproven, eco system of technologies, suppliers, partners, EPC contractors, and supply chains. The risk of new CCUS technology failures is high.

A recent CCUS report published by the Institute for Energy Economics and Financial Analysis (IEEFA) concluded that:

- Failed and underperforming CCUS projects considerably outnumbered successful experiences.

- Successful CCUS projects clustered in the natural gas processing sector serving the fossil fuel industry, which lead to further emissions. Enhancing oil production through the use of natural gas is not a climate solution; it actually produces more hydrocarbon emissions.

- Thus, there is an elephant in the room concerning the application of CCS/CCUS in the natural gas processing sector: Scope 3 emissions are still not being accounted for.

- Many financial and technical risks accompany the use of carbon capture to extend the life of fossil fuel power plants. Some applications of CCS in industries where emissions are hard to abate (such as cement) could be studied as an interim partial solution with careful consideration.

Clearly then the costs of CCUS and the associated risk of failure is high.

A few of the challenges and risks for new energy transitions technologies are outlined below:

Unfortunately, the risks outlined above are inherent in all of the technologies required by the overall energy transition.

Where can you start to mitigate these CCUS investment risks?

While there is no magic wand to eliminate these risks, there are common sense steps that you can take to minimize risk and partner with the right suppliers:

- Create a certified carbon footprint baseline.

- Use recognized emissions measurements.

- Conduct a CCUS landscape analysis.

- Identify potential CCUS technologies and partners.

- Conduct CCUS supply chain mapping.

- Assess supply chain risks.

- Develop risk mitigation action plans.

This is the first of three monthly articles on the energy transition and how SGS Maine Pointe can help.