Six Practical Initiatives US Chemicals Executives Can Implement Now to Drive EBITDA and Cash Improvement

1. Total Value Optimization™ (TVO)

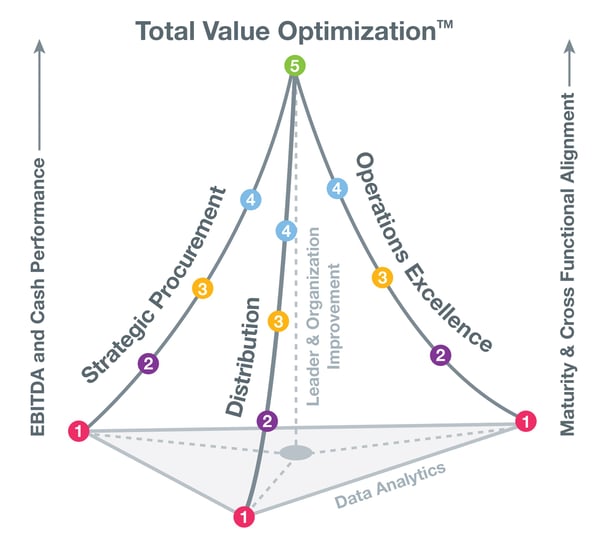

A pragmatic, step-by-step way to transform your supply chain into a competitive weapon. Competing on cost is no longer an option; only those that compete on value will win. Total Value Optimization™ is about transforming your supply chain into a competitive weapon while driving positive behavioral change across your organization. TVO is not a big-bang corporate initiative, instead it takes a practical, step-by-step approach to helping CEOs and their organization move up the TVO Pyramid™. The approach is about mapping out a portfolio of financially measurable initiatives that can be implemented over time.

The TVO Pyramid™ illustrates how, in order to drive synergy, savings and an on-demand customer service, the different functions become increasingly interdependent as a company moves up the Logistics, Operations and Procurement maturity curves. Effective change is then enabled by the effective deployment of Data Analytics and Leader & Organization Improvement (LOI) capabilities. These help organizations understand why and how change and innovation must happen in order to move up the maturity curves and achieve measurable and sustainable EBITDA and Cash improvements.

2. Pre or Post Merger: Drive synergies and value across business units and functional silos

Most executives recognize the fact that ‘silos’ within an organization’s supply chain are a material barrier to growth, efficiency and customer service, yet still those silos are pervasive. Many are already struggling to synchronize their Procurement, Operations, Manufacturing, Logistics and Fulfillment operations to anticipate demand and effectively meet customer requirements. Add a spate of recent acquisitions and more on the way, and synchronization moves even further from their grasp. However, those companies that can overcome the hurdles and break through the functional and business silos to optimize synergies and compete on value will genuinely achieve competitive advantage.

Carrying out an Analysis spanning all functional areas including Procurement, Logistics and Operations across different business units will unearth significant opportunities to improve EBITDA and Cash. This helps assess where bottlenecks and functional silos reside. Focusing on only one function reinforces the danger of a siloed mentality and can overlook the significant opportunities at hand for cross-functional alignment and synchronization.

3. Materials (direct and indirect) diversification and management including increased optionality

Although most companies across the board have gone through several rounds of cost cutting to drive a higher EPS, these cost-cutting programs tend to be driven by the “total cost of ownership” framework. As a result, millions of dollars could be left on the table because of a fragmented and inefficient supply chain. The key lies in a differentiated experience to the end customer based on proactive value creation – TVO.

TVO changes the nature of your supplier relationships. It breaks down supplier formulas to re-orient their engagement toward a lower cost basis, reducing your direct materials cost. It is a more forward-thinking strategy that takes a holistic view to optimize the impact on your organization’s top and bottom line. In our experience, mature organizations tend to gain an additional 3-5% cost reduction, whereas moderately mature and low maturity organizations tend to gain 8-14% and 15-20% cost reduction respectively.

4. Logistics, distribution and warehouse cost optimization

Under TVO, logistics is tied to procurement optionality and flexibility to ensure a high speed of response. As one of the major cost components, logistics, freight and warehousing/terminalling costs can have significant impact on EBITDA. More often than not, a typical analysis involves the assessment of Origin and Destination pairs to evaluate the optimal network design. Such an analysis, while providing insight into opportunities for network modeling, seems to lack a depth of understanding of the carrier/service provider costs and its operating structure as well as each chemical company’s unique set of business, safety and environmental requirements.

By representing freight and service value in the market place’s own language, in our experience, clients are able to create greater efficiencies in carrier/service provider commercial terms and dollars. Such efficiencies enable unforeseen service improvements at a decreased cost to the client that also produce dramatic enhancements to a carrier/service provider’s ability to lower their cost.

Engagements around logistics improvement tend to deliver 8-12% logistics cost reduction while, at the same time, improving service levels and delivering a “win-win” relationship with the carriers/service providers.

5: Conversion cost rationalization through footprint optimization and Operational Excellence

Companies tend to have several initiatives running parallel to each other when it comes to operational excellence. More often than not, these initiatives tend to be run through internal improvement organizations that bring a significant amount of subject matter expertise to the task at hand. The parallel/silo nature of projects tends to miss the value creation potential from a value chain perspective. For example, the interplay between yield improvement, energy cost management and overall planning and scheduling tends to be underestimated or, even when identified, not actioned. As such, the challenges involved with such initiatives tend to be around pace of implementation and magnitude of improvement owing to the silo nature of the initiatives and overall sustainability of improvements.

6: Operational Excellence driving superior customer service metrics to boost organic growth

Several specialty chemicals companies who differentiate based on added value and innovation are already seeing signs of growth. The principal concerns for these companies are share protection and gain, driving revenue acceleration, and margin appreciation. Typical challenges associated with customer service metrics such as on-time delivery tend to be a result of organizational gaps, and poor management frameworks and processes across the entire value chain.

Without a holistic approach, companies simply tend to shift the issues to another part of the value chain. To get a head start and capture value from expected future growth, now is the time to embark on a program that tackles challenges in your end-to-end value chain through Total Value Optimization™.