Due Diligence & Post Merger Integration

Improving competitiveness, confidence, integration,

synergy savings and time-to-value realization.

Due Diligence & Post Merger Integration Approach

SGS Maine Pointe’s hands on, accelerated approach to due diligence uncovers value opportunities and positions buyers to capture supply chain and operations-oriented value creation opportunities post-acquisition.

Our supply chain experts combined with our digital and systematic approach to diligence helps corporate and private equity buyers become smarter in their buying decisions. The validation and refinement of the investment thesis enables buyers to accelerate the integration and time-to-value realization process.

Post engagement our cross-functional integration, change management and data analytics capabilities are critical components to driving synergy savings and associated integration and value creation benefits aligned to your financial goals

This approach is integrated into our end-to-end supply chain and operations transformation approach called Total Value Optimization.

Benefits

- Identify & quantify supply chain opportunities earlier

- Increase bidding competitiveness

- Improve win rate on target companies

- Reduce acquisition risks

- Ensure integration & synergy capture

- Accelerate time-to-value realization

- Maximize exit value on carve-outs

- Eliminate silos and drive cross-functional alignment

- Drive measurable improvements in cost, cash, resilience and growth

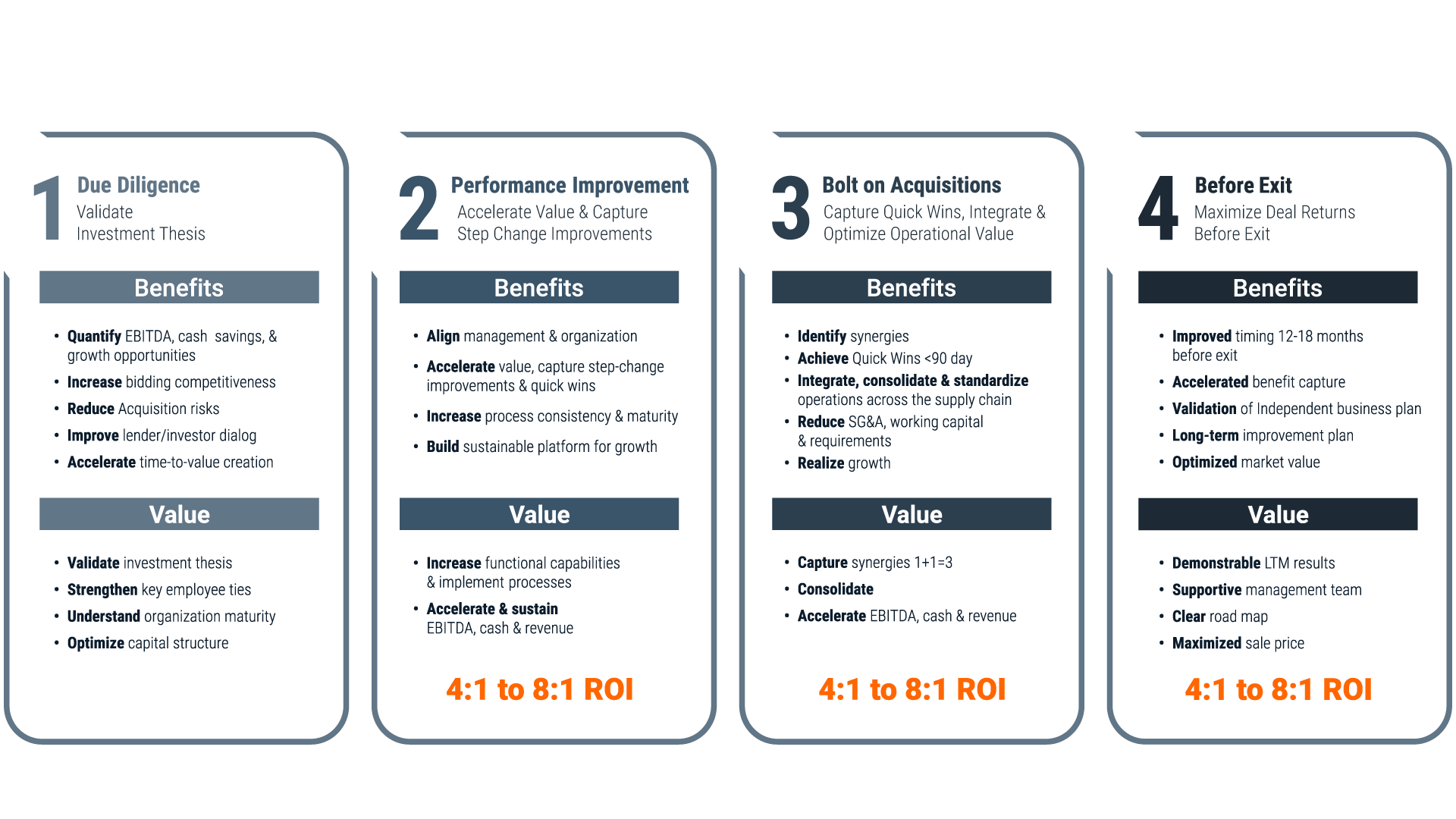

Pre and post-acquisition services

Our comprehensive set of pre- and post-acquisition implementation services helps improve your confidence and competitiveness and accelerate integration and time-to-value realization.

Intelligent automation and future of due diligence for private equity

The standard due diligence traditionally carried out by firms is, under normal circumstances, usually adequate – but we no longer live in normal times.

This article discuss how:

- Intelligent automation reduces risks and enhances confidence through better decision making

- Is a more holistic, agile approach to decision making

- Is a smarter approach to identifying and driving value creation

Due Diligence & Post Merger Success Stories

Driving measurable and sustainable change

Post due diligence, the first 20% EBITDA savings were realized within the first 30 days of the 100-day plan.

Read Story ➔

Step by step TVO implementation drove transformational results and $112M of benefits in a complex post-merger environment.

Read more ➔What Our Clients Say

Experience the difference

“SGS Maine Pointe consultants, working side-by-side with our team, elevated our competitive edge in the market place and positioned our company to absorb additional work through sales via organic growth or mergers and acquisitions."

Mike Lane

CEO, Nevco

Talk to us

Have a particular business challenge you'd like to address?

Submit this contact form to speak with one of our executives.