2023 Priorities: Free Up Cash, Reduce Costs, and Improve Service

Many businesses and investors are finding that in an environment with tighter lending practices, higher interest rates, and inflated operational costs, that their cash is tied up in inventory, receivables, and payables. As a result, managing liquidity and raising free cashflow will be a top priority in 2023. Dan Ginsberg, Managing Director, SGS Maine Pointe, outlines why a holistic approach to optimizing working capital needs to balance releasing cash with reducing costs and improving service.

Corporations and private equity investors will need a renewed focus on optimization of working capital in 2023 as higher interest rates, inflationary pressures resulting in increased operational and inventory costs, and continued disruption in the end-to-end supply chain bring new challenges to the new year.

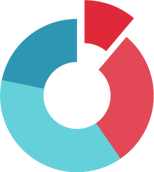

To make the most of new opportunities and minimize risk, corporations must take a more thoughtful approach built on three pillars of working capital optimization: release cash, reduce cost, and improve service. The result affords companies and the private equity investors that fund them with greater liquidity and flexibility, along with a more accurate picture of available cash.

The Triple impact: Cash, cost, and service

The extraordinary pressures going into 2023 may see corporations panicking over reduced availability of cash. This does not have to tip the corporation into crisis mode, but it does require a holistic and proactive approach that goes beyond simple reactionary measures. Built on Total Value Optimization™ (TVO), this step-by-step approach helps organizations break out of functional silos for greater visibility, while sustaining that transformation with deep analytics and Leader and Organization Improvement (LOI).

Those three pillars acknowledge that working capital optimization is never a one-size-fits-all proposition, nor should it be limited to only one area such as cutting costs. A true multi-disciplinary TVO approach will work across the entire organization and supply chain. The process will align sales with inventory using Sales & Inventory Operations Planning (SIOP) to overcome the common mismatch between actual and anticipated sales, and physical inventory in the pipeline, a mismatch that could lead to unfilled orders and poor service levels.

Inventory, receivables, payables. Three levers working together.

By balancing optimization across inventory, receivables, and payables, management can free up cash, reduce costs, and improve service, while developing a continuous cash culture. Additional benefits will also include lower debt interest and operating expenses, reduced asset requirements, gains in capacity, and a greater opportunity for self-funding initiatives.

- Inventory – Inventory issues, frequently at the root of cash flow crises, may lead to a deluge of cash-related issues and service levels. In addition to aligning sales with inventory to deliver more predictability and more accurate materials scheduling, improved forecasting and planning will also lead to a better cost scenario. SGS Maine Pointe assisted a manufacturer to identify areas of opportunity using analytics, establish performance targets for inventory management, and implement improved inventory control. The result was a 20% improvement in operational productivity, procurement savings at 10% of addressable spend, and a better connection between Sales and Operations.

- Receivables – Receivables optimization will focus on reducing the quantity of potential disputes and monitoring the dispute cycle. Contract structuring and optimization of customer terms will deliver a quick cash boost, and offering discounts will also improve service while also speeding up the payment cycle. SGS Maine Pointe assisted a marketing services company to reduce DSO by 20% and embed standardized best practices within billing, credit and collections, increasing cash flow by 18%. Doing so created a cash culture throughout the sales organization, and provided deeper visibility into receivables with actionable metrics.

- Payables – A traditional driver of cash, optimizing payables by taking advantage of price discounts and continuous re-evaluation and re-negotiation of payment terms will deliver a positive impact as well as a short-term boost to the P&L statement. Strategic sourcing procurement and automation will also deliver an increase in both cost and service. In one example, SGS Maine Pointe assisted a manufacturing concern in implementing best practices in payables by rolling out a shared-service model across multiple divisions, improving EBITDA by 8.4%, annualized savings of 3.3%, and lowering inventories and stretching payment terms to save $2M in working capital.

Unlock cash and minimize risk

Optimization of working capital using a Total Value OptimizationTM strategy will better position you to meet both current and future challenges, meet your growth goals, and leverage the benefits of a systematic, ongoing improvement of cash flow. Focusing on this holistic strategy will reduce risks, position you better for new opportunities, and ensure greater end-to-end visibility and operational success.

SGS Maine Pointe can help unlock your company’s full potential, drive sustainable, long-term improvements in cash, cost, and service, and ensure continued resilience through the most challenging economic climate. For more information, contact SGS Maine Pointe to unlock a new, balanced approach to free cash flow.