2018 Private Equity Survey: Impact of operating partners

Foreword

Increased reliance on operational value creation in recent years, especially in fund vintages since 2011, has required PE firms to diversify from their traditional ‘financial engineering’ role and either develop the in-house capabilities or look outside of their own organization for the operational expertise they require to achieve rapid, measurable results.

In 2015, Maine Pointe conducted a snapshot survey, on the status and trends in the use of the operating partner concept in the Americas and Europe, to ascertain the perspectives of 50 managing partners/operating partners and senior directors on the use of the operating partner concept. From that survey, we learned that approximately half of all middle-market and larger PE firms utilize operating resources internally, and most PE firms are working with various third parties to achieve improved operating results.

Now this begs the question, how effective are these operating resources in creating incremental value? This year, we dove into this theme with a new survey aimed at taking PE’s pulse regarding current methods of utilizing operating resources and the barriers preventing PE firms from driving more value in cost reduction and cash flow from portfolio companies. The survey specifically focused on the role of operating partners, asking how and when they are involved in the process and what financial impact their involvement has on value creation.

Methodology:

The survey was carried out over a 2-month period in April and May 2018 and consisted of an online questionnaire supported by face-to-face interviews with 50 operating partners in North America and Europe. The survey group was made up of full-time employees whose role is dedicated to creating and driving operational performance in portfolio companies, as well as part-time operating advisors and operating teams.

Summary of Findings:

• The over-arching finding from the survey is that while the use of operating resources is relatively high and continues to grow, the measurable effectiveness of these resources is unclear. We may not truly understand the alpha – or the incremental value creation result – until we have more time to observe these recent vintage fund performances.

• Most PE firms surveyed believe direct initiatives within their teams are capable of driving a higher level of cost reduction, cash flow, and/or growth in portfolio companies than is currently achieved.

• However, lack of skilled resources available in-house, time constraints, and difficulties getting CEO/management cooperation are cited as among the chief barriers preventing PE firms from driving more value in cost reduction and cash.

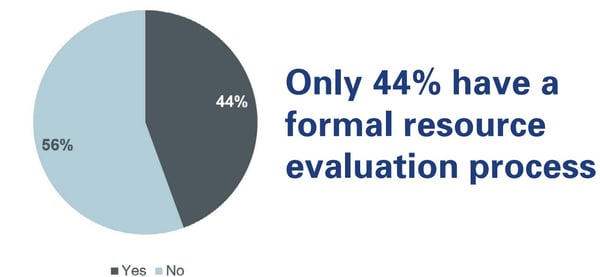

• 60% of respondents either lack or are unaware of a formal process for resource evaluation. This is mainly due to operating groups heavily relying on their networks and word-of-mouth, as opposed to using data-driven results when selecting a third-party resource.

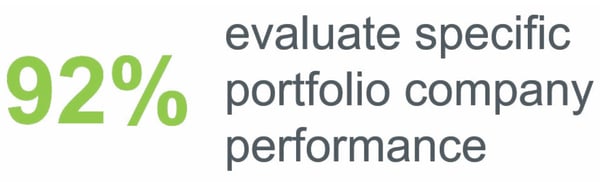

• 92% view individual portfolio company performance as the key performance metric.

Detailed Findings

A lack of skilled resources means internal performance frequently falls short of expectations. The majority of PE firms believe direct initiatives within their teams are capable of driving a higher level of cost reduction, cash flow and/or growth in portfolio companies than they currently achieve.

Operating partners are seeing a gap between how much cost reduction, cash flow and/or growth in portfolio companies is directly driven by initiatives with their team and where they think it could be. Most are saying less than 30% of cost/cash reduction is directly driven by initiatives, although they think the value potential should be more around 30-50%.

Lack of appropriately skilled and qualified resources, time constraints, and difficulties getting CEO/management cooperation are major barriers preventing PE firms from driving more value in cost reduction and cash flow.

There can be little doubt that finding the right talent and skilled resources continues to be a significant concern for many PE firms trying to drive more value and improved operational performance. The challenge is the competing initiatives that inevitably exist in every firm to drive continuous improvement on cost and working capital. Those efforts are always in play but are often a secondary issue for the CEO, whose primary focus tends to be on growth.

56% of respondents either lack, or are unaware of, a formal process within their organization for resource evaluation. This confirms what we are seeing in the market, that many PE firms do not have the processes or the tools they need to evaluate their employees. This makes measurement of success challenging.

There is clear delineation between the role of operating partner and deal partner.

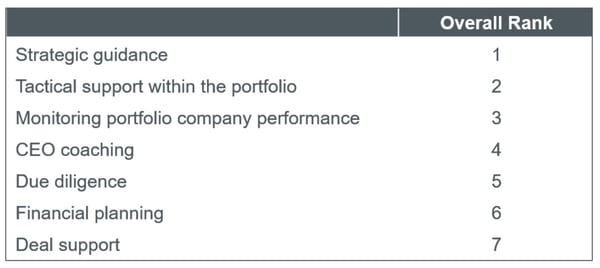

The areas of focus that are viewed as most important for operating resources are strategic guidance, tactical support, and performance monitoring, with due diligence, financial planning, and deal support further down the list. This confirms that operating partners recognize natural boundaries between their role and those of financial planning and deal support, which are owned by the deal partners.

Strategic guidance is a common role of operating partners, particularly those with significant industry experience. The operating team provides tactical support rather than driving transformational change across their portfolio companies. Performance monitoring frequently falls under the remit of the operating team to enable proactive identification of any issues during the investment lifecycle. Due diligence, on the other hand, is typically the focus of deal partners and other players within the private equity firm.

Portfolio company performance is the key metric for operating partners.

Specific portfolio company performance is the key performance metric in the vast majority of cases (92%). Operating resource compensation is predominantly tied to performance, with EBITDA, fund development, and value creation also listed as key performance measures. It’s common for operating partners to have their performance primarily driven by the financial performance of investments. Measuring performance and taking action accordingly is a natural process, although it often stops action from occurring proactively to prevent performance dips or accentuate performance.

Revenue generation, direct cost reduction, and cash flow growth are ranked as the three most important areas of focus for performance improvement initiatives, closely followed by executive development. Supply chain functions (logistics, operations, procurement) were, somewhat surprisingly, ranked as only relatively unimportant. Not recognizing the value potential of improving the end-to-end supply chain is leaving tens if not hundreds of millions of dollars on the table.

Almost all investment theses have growth as the primary driver of value creation. Cost and cash are critical components as well, either funding working capital or creating EBITDA uplift, which by itself has a multiple and can also fund growth.

This result demonstrates an awareness of the significant part played by individuals on the ground, a view that was confirmed in our one-to-one interviews with PE company executives:

“You need the right individual on the ground to lead change efforts alongside a sound business system; accountabilities, measured, followthrough etc. Overall, it’s easier to achieve cost savings, but harder to achieve growth objectives”

Operating Partner, Global PE firm

The relatively low importance given to supply chain functions was somewhat surprising and indicates a significant lack of understanding and expertise in many portfolio companies relative to supply chain and/or operations leadership. Companies are often purchased without this strength or may lose it during the M&A process. It’s very common to see this gap but, with the focus on growth, it only gets the attention it deserves if the value creation plan relies on it as a priority over front-end investment. Moving up the maturity curve in supply chain capability has to be tied to company growth objectives, and recognition of the importance of resources. Many organizations are low on the maturity curve and therefore don’t realize the potential gap in performance.

Average length of performance improvement initiatives is between 4-6 months

The average length of a performance improvement initiative is between 4-6 months and yields, on average, between 1-20% EBITDA improvement with results taking around 1 year to impact financial statements. The main focus of these initiatives is revenue generation, cost reduction and cash flow growth.

This aligns with the more tactical performance improvement initiatives performed by operating partners. The focus of these initiatives is consistent with revenue generation, cost reduction and cash flow growth. A TVO™ transformation project across supply chain and operations would typically take longer to complete but yield a higher return with accelerated results.

Past experience and client references are deciding factors to use third parties

Operating partners typically bring in third-party resources to support due diligence and improve data analytics and IT capabilities, as well as to support supply chain and operations improvements. When selecting a third-party partner, past experience and client references are deciding factors.

Specialty expertise supported by experience and references is almost always the most important criteria. It's common for the PE industry and portfolio companies to believe that unique elements of their business drive business improvement design. However, recognizing that general management, leader and organization improvement skills, and overall management operating disciplines drive huge results in almost any industry, can be a missed opportunity. Operating partners typically bring in third-party resources to leverage deep expertise and industry experience to accelerate change and drive increased value creation within their portfolio companies.

Conclusion

The importance and value of operating partners continue to grow within the PE marketplace. Operating partners are driving value, but there are some difficulties in measuring performance. While more firms are using operating partners to drive value, there is a distinct lack of clarity around the most effective model. A growing focus on value creation to achieve returns has forced PE firms to evolve their skill set. Investors demand results and want to know how the PE firm plans to deliver them. Finding the right individuals with the right experience on the ground remains a challenge, as survey results support.