Act Now to Protect Margins in a Rising Commodity Market

The challenge is only going to get bigger

According to the World Bank's Global Prospects Report for January 2018*, global growth accelerated to 3% in 2017 and is expected to edge up to 3.1% in 2018. This is already having an impact on margins, with some commodities rising by as much as 25% during 2017. Many economists and analysts are predicting that continued strong global demand across the commodity complex will outpace supply. In the US, the Fed is signaling potential rate increases and corporations are beginning to react to the impact of favorable tax changes. Globally there is a strong outlook for growth, with synchronized expansion across both developed and emerging markets. Taking all of these increased demand and cost factors into account, we are looking at prime conditions for increases in commodity prices overall.

5 questions every CEO should ask to prepare for commodity price increases

- Are you able to protect your margins effectively across your portfolio of products?

- Is your organization mature enough to outstrip your competitors and engage and prosper in this environment?

- Are the commodities supply conditions in your industry and business elastic to these changes in demand?

- Is your supply chain prepared to address this ongoing reality?

- How much of your supply chain spend is tied to commodity based products or materials?

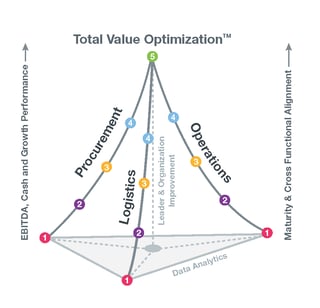

Once you have established detailed visibility into your specific commodity portfolio across your entire spend, there are several ways to effectively manage this underlying cost in your supply chain.

Indexing products - Maturity level 1 and 2

A large percentage of commodity products have reported "indices". These are commonly used to track the underlying value of a given commodity at a point in time. Even low-maturity organizations benefit from monitoring and utilizing indices to establish contracts, negotiate with suppliers and customers and benchmark the performance of sales and procurement efforts. If your supply chain is not linked to indices, your procurement efforts will largely be focused on buying at the best available price and either shopping or "buying from whomever we have always bought from". In either case, long term results are that you sometimes win and sometimes lose relative to buying at the best price. Linking your products to an index allows for your purchases to be managed directly to the market. This avoids a situation where suppliers raise your price immediately when the market goes up but move slowly to agree to concessions when the market goes down. Make sure your supply chain is meeting or beating appropriate indices for your commodity purchases.

Basis - Maturity level 2 and 3

As organizations mature, we see basis being included into commodity pricing agreements. One definition of basis is the variation between spot price of a FOB purchased commodity and the relative price of the same product delivered to the destination at a specific date. Mature organizations negotiate basis in addition to locking into an index with their commodity suppliers. For example, if we purchase a commodity that is traded on the CME, soybean oil for example, the CME index defines specific delivery points, quality standards, volume (trading units), storage charges, terms and fees associated with the quoted index. If the index used is delivery point Illinois, but both your facility and the supplier's facility are located in Kansas, you should be able to negotiate a lower freight rate to your facility direct from factory. Basis also takes into account time and risk adjustment. For instance, if it's believed the market will drop over the coming months, a supplier might offer a discounted basis (negative basis adjustment) in anticipation of lower prices. If they feel the market will rise, they may want a higher basis and adjust upward. Make sure basis is emphasized in agreements and well understood across your supply chain organization.

Microeconomics of your supplier community - Maturity level 3 and 4

In addition to the commodity index pricing and basis of a commodity, it's important to know the underlying economics of your suppliers. While many organizations and suppliers are content to trade based solely on commodity indexes or negotiated contracts, higher maturity clients and suppliers will manage their relationships sufficiently to understand the impact of their purchases on the economics of each supplier. For example, if a plant is operating at 30% capacity, they will be more likely to offer a "below market price" or negative basis adjustment than a plant that is operating at a 95% capacity. Maintaining a healthy business relationship with strategic suppliers enables both you and your suppliers to align on mutually beneficial agreements. Being able to work with supplier partners to best allocate your demand (future purchases) can drive significant value creation during periods of increasing commodity prices. In this way, as a recent success story demonstrates, even where there is a very small group of incumbent suppliers, you can achieve savings and reduce the threat posed by rising commodity prices. Make sure your supply chain group has documented knowledge of their supply community's SWOT (strengths, weaknesses, opportunity, threats) and that it is used in their supply chain strategy and decision making.

Creating the demand-driven supply chain - Maturity level 3 through 5

In addition to the value created through effective management of the above commodity insights, predictive data analytics is an essential tool for effective supply and demand decision making. In simple terms, advanced analytical tools can predict whether commodity prices are likely to go up or down and the order of magnitude of the event. At a low level of maturity, organizations can benefit from insights that would suggest buying heavier in anticipation of future increases in the market, or buying lighter in anticipation of lower prices. In more mature organizations, these tools are able to align forecasted commodity impacts with future demand requirements and seasonality of your organization's needs to drive value. Good predictive analytics allow you to align your suppliers' production efficiencies with your demand needs to allow for optimized commodity delivery without having to incur inefficient inventory costs in the supply chain. You become a "most sought after" customer from your supply community since you can more effectively align your business needs with supply conditions. For instance, a specialty chemical company made significant savings using insights gained from data analytics to improve margin awareness and develop smarter buying strategies. Make sure you're getting the most from your data and integrated data analytics and that it is used throughout your organization's supply chain strategy and decision making.

Source: World Bank January 2018 Global Prospects Report