Beating the chemicals-by-rail congestion challenge in the Gulf Corridor

With over $90bn of new plants coming online across the US Gulf Corridor, demand for freight is set to outstrip limited track capacity. Shippers operating along the Corridor need to take action now to protect their margins, competitiveness and product time-to-market.

This perspective considers some of the key actions bulk shippers can take to not only overcome the threat to their future growth, but also seize an opportunity to establish themselves as the Class 1 rail carriers’ preferred customer.

This perspectives paper considers some of the key actions bulk shippers can take to not only overcome the threat to their future growth, but also seize an opportunity to establish themselves as the Class 1 rail carriers’ preferred customer.

Shippers in the Gulf Corridor face a painful truth

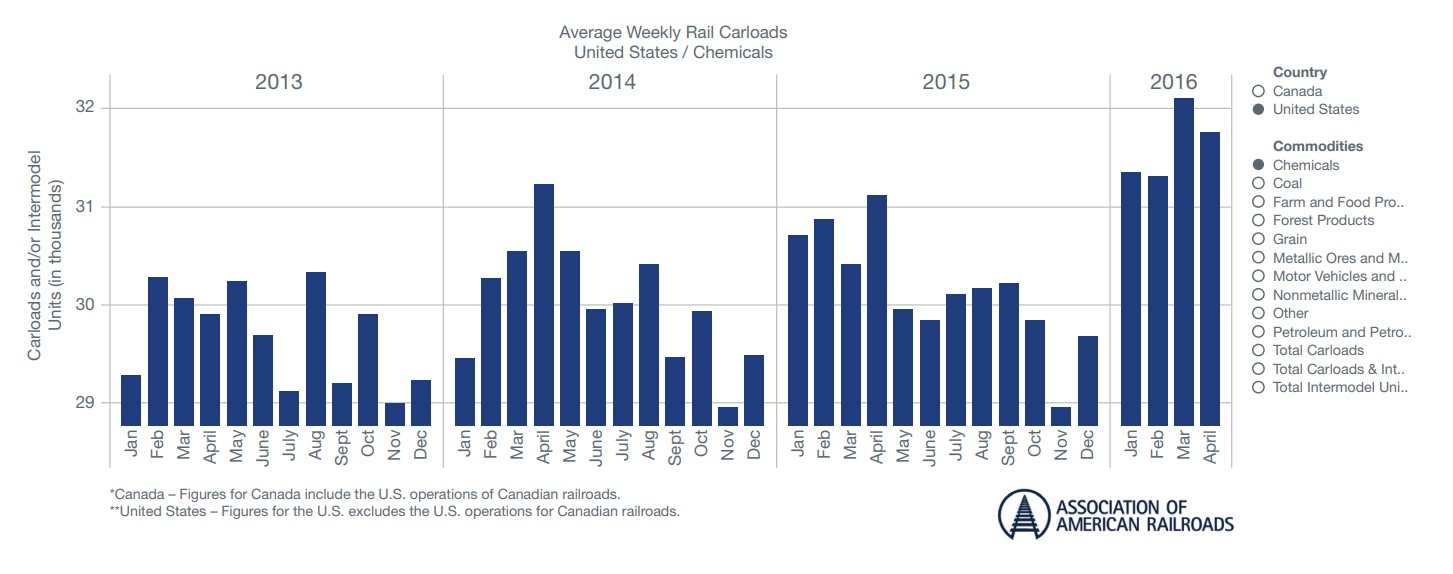

Demand for railcars and storage increased dramatically in the first quarter of 2016 (figure1), while the number of major railroads has dropped from a high of 26 to just 7 over the last 2 decades.

According to the ACC, rail freight charges increased by nearly 100% in the decade from 2005-2015 and all indications are that they will continue rising fast. At the same time, the level of service is, at best, remaining static and, at worst, deteriorating.

The way forward

Needless to say, as the costs of logistics, storage and maintenance threaten to spiral out of control, finding ways to minimize the impact on cost, margins, competitiveness, level of service and time-to-market is high on the CEO agenda. The most successful companies have learned how to fully optimize their plant shipping operations. They are taking advantage of alternate modes of transport such as truck and barge and aligning their requirements with the operational and commercial objectives of the carriers.

Overcoming the captive challenge with the Class 1 railroads

According to CURE (Consumers United for Rail Equity), more than 78% of rail service locations in the continental US are served by a single major railroad. As a result, the majority of shippers are in a captive situation. Many executives respond to this by adopting a passive service management model. They are frustrated that they are paying premium prices for a third- rate service, but don’t know how to make themselves more attractive customers to the carrier.

The key to achieving sustainable EBITDA and Cash benefits is, first and foremost, to recognize how valuable you are to the railroads as a customer. Use this knowledge to take control of the relationship by reducing your dependency on rail as a mode of transportation. Then, approach the rail carrier at CEO level to negotiate improved margins and gain cross-departmental consensus from the railroad regarding their value proposition.

3 ways shippers can capitalize on new opportunities to protect margins, competitiveness and improve time-to-market

1. Look at ways to make your logistics and supply chain less dependent on rail

This may sound obvious but making the right choices and implementing them safely is harder than many executives think. Increased demand means more chemical shipments by truck and barge as well as by rail. This has led to more interest and investment by third-party logistics companies and transport operators such as Quality Distribution (the second largest US bulk trucking operator) in the lucrative chemicals business. In addition, the opening of the expansion of the Panama Canal will double the Canal’s capacity, with an impact on economy of scale and international maritime trading. As supply chains become more sophisticated, companies need to break down the silos to optimize synergies. Executives who have become used to doing things in a specific way can sometimes struggle to take an objective view of their logistics. Getting an expert view from someone who understands both the shipper and the carrier point of view can prove to be invaluable.

Under Total Value OptimizationTM, logistics is tied to procurement optionality to ensure that the organization has full visibility of its own fleet and Third Party logistics distribution network. Maine Pointe’s engagements around logistics improvement typically deliver 8-12% logistics cost reduction while, at the same time, improving service levels, and strengthening the negotiating position with the Class 1’s. This is evidenced by our work with a major chemical manufacturer and distributor to optimize rail and road logistics. We helped them to rebuild the, potentially ruinous, relationship with their rail carrier and to ensure that their own truck fleet operations were competitive and optimized for performance. The result was a 5% reduction in logistics costs, a ROI of 7:1 (truck) and 3:1(rail) with $20M in additional savings forecast in year 1.

2. Improve efficiency and effectiveness in your own operations

In our experience, when companies align the “clock speed” of the various functions and components of their supply chain, eliminate waste in the forms of excess inventory and order-to- cash performance and break down cross-functional silos, they achieve significant benefits in terms of improved internal fleet management. Specific areas for operational improvement include greater consistency in plant shipping operations, better car management, simplified railroad operations and a greater understanding of problem areas in terms of transit and dwell resolution in order to free up capacity. Optimization can lead to improved fleet velocity, better customer service and rebates from the rail carrier to offset any increases.

While most CEOs are fully aware of the value that operational excellence can deliver, many lack the internal capability required to develop and implement a ‘best in class’ Logistics Management Operating System (LMOS). An example of the benefits this can deliver is our work with a client that had ambitious expansion plans. We helped them put in place a formal, mutually beneficial agreement with their Class 1 rail carrier and a 3rd party switcher. The spirit of partnership this engendered, enabled them, with our help, to develop and implement tools and methodologies that facilitated visibility around the total cost of the logistics operation. The results were a 50% reduction in dwell time for outbound loads at the Class 1 service yard, increased weekly takeaway potential and dramatically reduced rail yard car dwell.

3. Create a win-win relationship with the Class 1 rail carriers

With suppliers seemingly holding all the cards, who will they choose to prioritize? It’s possible to turn even the worst shipper/ carrier relationship into a mutually beneficial partnership but first you need to speak each other’s language. We frequently find that communication problems are caused by a failure to deal directly with the right people at the right level to understand and resolve on-going issues.

Aligning common goals and gaining full C-suite understanding of the level of mutual benefits that can be achieved through better cooperation, lower costs and improved time-to-market can result in both the shipper and the carrier becoming winning players. Regular sharing of information is a start, along with listening and offering ideas and making sure that you all take part in finding solutions.

An example of the benefits this can deliver to both parties is the work Maine Pointe carried out with a major waste management company. The company was in a captive rail situation where inconsistent service from the Class 1 meant that they could not grow the business as forecasted. Our client’s company had attempted to resolve the situation but not communicated directly with the Class 1’s senior executives.

Leveraging the experience gained from working with over 100 shippers and over 300+ years of rail experience, we helped break through this barrier. We took their concerns to the right people at the right level to build a mutual understanding of each other’s position. Breaking through the communications barrier resulted in a 32% improvement in transit times and reduced costs for both shipper and carrier.

Where do you go from here?

As new plants come online across the Gulf Corridor and with little immediate prospect of any legislation to end the captive rail situation, executives should act now to protect their margins, competitiveness and product time-to-market. Deep logistics expertise often proffers the best hope for change. While the balance of power between shippers and carriers may never be truly level, exploring other modes of transportation, strengthening your operations and better communication can only help in forging a mutually beneficial, preferred relationship with your carriers.