US Chemicals and Materials: Capitalizing on the Top 3 Market Drivers

This Maine Pointe perspectives paper focuses on the key challenges and opportunities for the industry during the latter part of 2015 and as we move into 2016. It outlines four opportunities industry leaders can capitalize on now.

Adapt to succeed in a shifting landscape

The severe volatility that the chemicals industry is currently experiencing presents a fresh set of opportunities and challenges for senior executives. The industry has become increasingly unpredictable from a purchasing and supply chain management standpoint at the exact time when top–line organic growth is proving ever more elusive. If they are to succeed in this shifting landscape, chemicals executives need to re-focus their strategic thinking. This means abandoning outdated business models and developing the organizational agility to prepare for future shocks and take advantage of opportunities to capture value and minimize threats.

Some senior executives have chosen to “watch and wait” rather than make these key strategic decisions. By doing so, they run the risk of being left by the wayside as their competitors seize the opportunity to adjust their business model and gain the competitive edge.

Trends in the Industry

In such testing times for the chemicals industry, you could be forgiven for thinking that the outlook is pessimistic. However, when we look back at the first half of 2015, we can see that the chemicals industry and, by extension, the US economy has shown year-over-year growth, albeit at a slower pace than initially predicted.

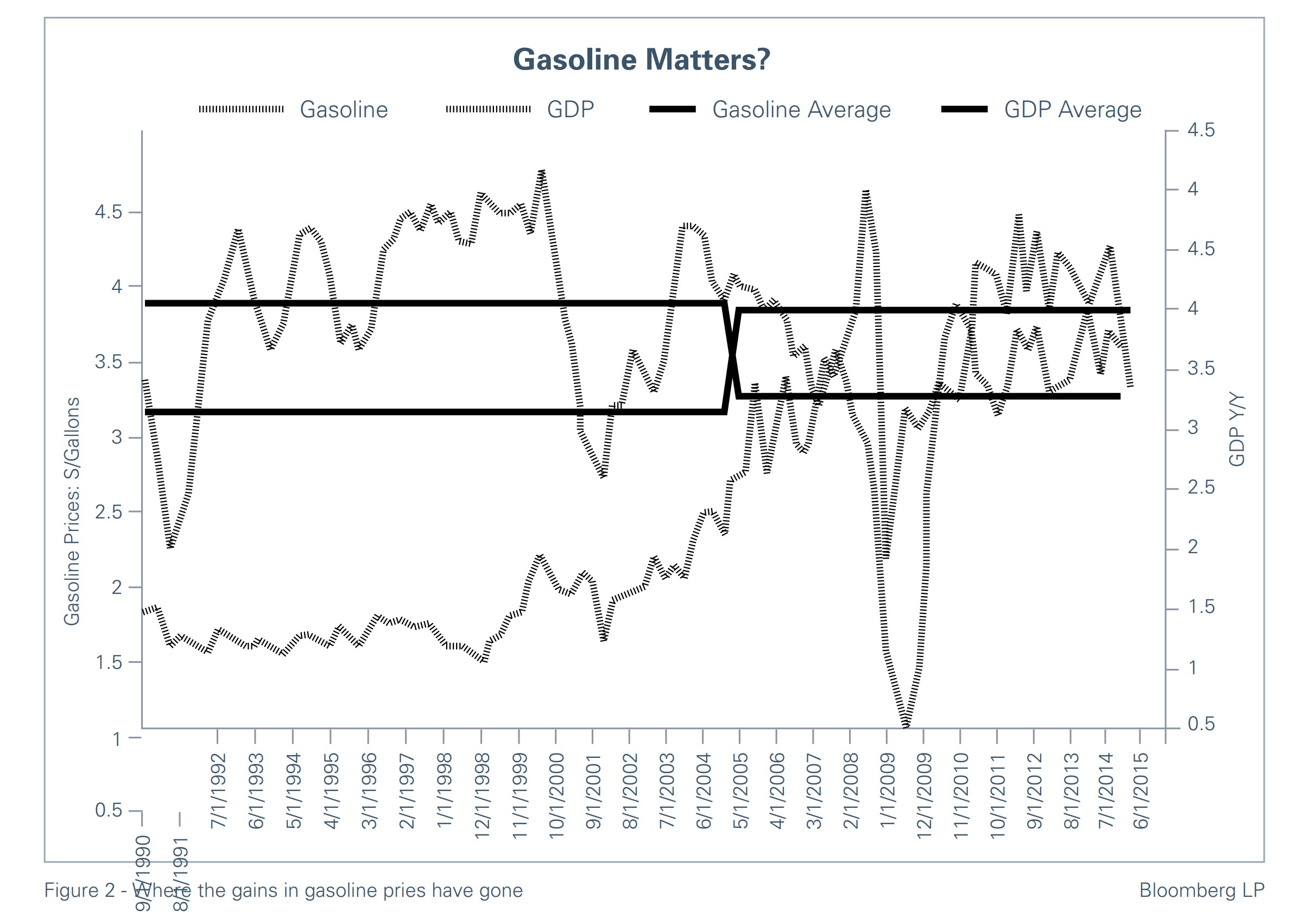

At the beginning of 2015, the expectation of GDP was 3.2%; the revised forecast for the same period appears to be 2.7. Similarly, the ACC has revised its 2015 growth estimates for chemical production from 3.7% down to 3.2%. At the macroeconomic level, the price of oil, US consumer spending and the strengthening of the US dollar have all had a significant impact on the chemicals industry. So what are the key drivers that are impacting the industry and how can industry leaders leverage them for competitive advantage?

Three market drivers that are impacting today’s Chemical industry

Driver 1. Oil Prices leading to major changes/increases of supply

Many global chemical producers were caught off guard by the sharp and largely unexpected drop in oil prices in the second half of last year and predictions of continued volatility for the remainder of this year. The reduction in oil price caused a major wealth transfer, $1.5 – $2 trillion, to consumers as well as downstream and feedstock-disadvantaged producers and geographies. Raw material pricing volatility has also contributed to de-stocking through the supply chain and inherent uncertainty as the pace of adoption of new products and volumes slowed down. Volumes in basic, as well as specialty chemicals, were down month-over-month in April and May.

Driver 2. Consumer Spending driving increases in demand

This year, American Consumers have been showing a higher level of confidence and spending ability that has, to some extent, counteracted the uncertainty driven by oil price movement. Job growth and housing are showing steady signs of recovery. With a low national month’s supply at just over 5, housing starts were 26% higher in June compared to year ago (driven primarily by multi-family housing).

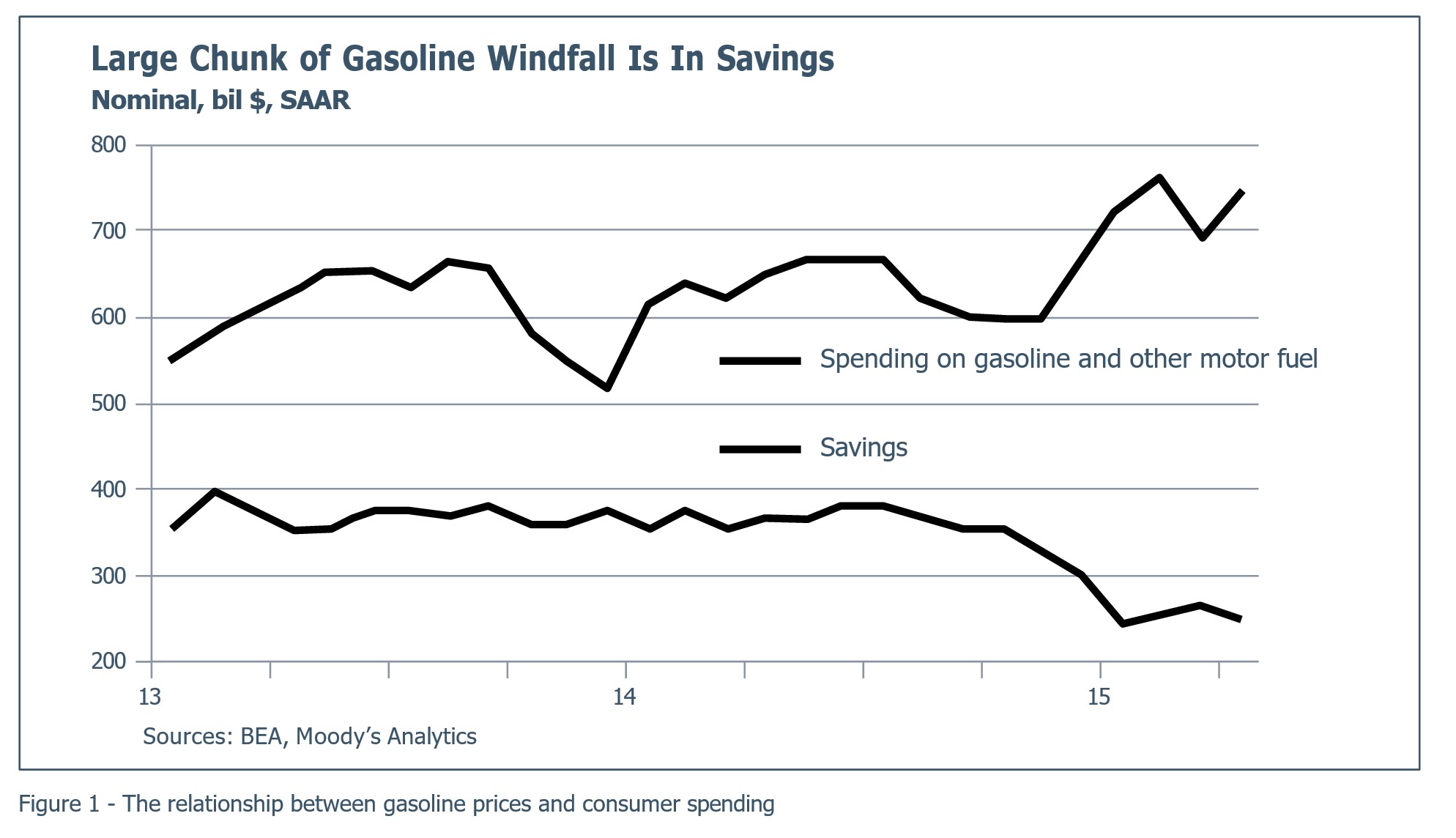

Overall, these indices are a good indication that the economy is slowly picking up with consumer spending forecasted to increase 3% YoY for Q3 of 2015. The challenge to industry growth remains with the relative ratio of savings to spending. So far, the majority of the reduction on gasoline spend has gone towards savings rather than increased spending. As such, we can expect to experience a lag between improving metrics on the economy and the expected increase in spending.

Driver 3. The Dollar

The third factor adding to the volatility for chemical companies, especially multinationals, has been the strong dollar. While Fed’s July beige book reported mixed/flat growth, the April report indicated a slowing down in the chemicals industry specifically in the St. Louis and Kansas City districts. The Dallas district reported that the strength of the dollar had led to a drop in export demand.

Compounding the effect of reduced export demand is the margin erosion caused by Forex changes. Organizations with a mature supply chain were prepared for these changes and integrated them into their decision making.

So what do these 3 key drivers indicate and how does that translate into key actions and imperatives for the industry? Firstly, we can expect there to be a lag for the favorable impact of an improving economy. This will occur while consumer spending and housing recovery have time to compensate for and/or surpass the effects of uncertainty from oil prices as well as the negative impact of the strong dollar. Many industry participants tend to act quicker in response to changing macro-conditions than the average consumer. As a result, it will take time for the wealth transfer from falling oil prices as well as job creation to trickle down into increased local demand, higher US GDP and a robust local chemicals industry. While some chemical producers are actively moving the needle, others are watching and waiting and, by doing so, missing some potentially game-changing opportunities.

Four opportunities to capture value you can capitalize on now

This lag represents a short window of opportunity to capture value, especially as valuations have tended to be on the high side and deal making is at an all-time high. There is also an opportunity for a critical review of internal company processes for dramatic, yet predictable, improvements in an otherwise uncertain time for the industry. As top-line organic growth stays elusive, focusing on internally controllable outcomes such as materials cost management, distribution and freight cost optimization as well as operational excellence gives chemicals companies better control over their destiny and earnings, locking-in favorable cost positions before major growth resumes in earnest.

Opportunity 1: Materials (direct and indirect) diversification and management including increased optionality

Although most companies across the board have gone through several rounds of cost cutting to drive a higher EPS, these cost-cutting programs tend to be driven by the “total cost of ownership” framework. As a result, millions of dollars could be left on the table because of a fragmented and inefficient supply chain. The key lies in a differentiated experience to the end customer based on proactive value creation – what Maine Pointe calls Total Value OptimizationTM (TVO). TVO changes the nature of your supplier relationships. It breaks down supplier formulas to re-orient their engagement toward a lower cost basis, reducing your direct materials cost. It is a more forward-thinking strategy that takes a holistic view to optimize the impact on your organization’s top and bottom line. In our experience, mature organizations tend to gain an additional 3-5% cost reduction, whereas moderately mature and low mature organizations tend to gain 8-14% and 15-20% cost reduction respectively.

Opportunity 2: Logistics, distribution and warehouse cost optimization

Under Total Value Optimization (TVOTM), logistics is tied to procurement optionality and flexibility to ensure a high speed of response. As one of the major cost components, logistics, freight and warehousing/terminalling costs can have significant impact on EBITDA. More often than not a typical analysis involves the assessment of Origin and Destination pairs to evaluate the optimal network design. Such an analysis, while providing insight into opportunities for network modeling, seems to lack a depth of understanding of the carrier/ service provider costs and its operating structure as well as each chemical company’s unique set of business, safety and environmental requirements. By representing freight and service value in the marketplace’s own language, in our experience, clients are able to create greater efficiencies in carrier/service provider commercial terms and dollars. Such efficiencies enable unforeseen service improvements at a decreased cost to the client that also produce dramatic enhancements to a carrier/service provider’s ability to lower their cost. Our engagements around logistics improvement tend to deliver 8-12% of logistics cost reduction while at the same time improving service levels and delivering a “win-win” relationship with the carriers/ service providers.

Opportunity 3: Conversion cost rationalization through footprint optimization and operational excellence

In our experience, companies tend to have several initiatives running parallel to each other when it comes to operational excellence. More often than not, these initiatives tend to be run through internal improvement organizations who bring a significant amount of subject matter expertise to the task at hand. The parallel/SILO nature of projects tends to miss the value creation potential from a value chain perspective. For example, the interplay between yield improvement, energy cost management and overall planning and scheduling tends to be underestimated or even when identified not actioned upon. As such, the challenges involved with such initiatives tend to be around pace of implementation, magnitude of improvement owing to the SILO nature of the initiatives and overall sustainability of improvements.

Opportunity 4: Operational Excellence driving superior customer service metrics to boost organic growth

Several specialty chemicals companies who differentiate themselves on added value and innovation are already seeing signs of growth. The principal concerns for these companies are share protection and gain, driving revenue acceleration, and margin appreciation. Typical challenges associated with customer service metrics such as On Time Delivery tend to be a result of organizational gaps, poor management frameworks and processes across the entire value chain. Without a holistic approach companies simply tend to shift the issues to another part of the value chain. To get a head start and capture value from expected future growth, now is the time to embark on a program that tackles challenges in your end-to-end value chain.

As specialists in procurement, logistics and operations, we know that there are cost savings to be found almost everywhere in the key areas of your value chain. Not only that, we have the experience, methodology and capability to deliver significant savings and help clients move up the high performance curve to achieve Total Value Optimization™.

Sources:

1. World Bank Global Economic Prospects June 2015

2. American Chemistry Council – Chemical Production Forecast and Estimates

3. IHS analysis

4. US Bureau of Economic Analysis

5. Forbes Business Report, June 2015