Working Capital Management Solutions

Managing Working Capital and raising free cash flow from operations are top priorities for businesses today as lending practices tighten, interest rates rise, and operating costs remain at inflated levels.

Working Capital is the cash used internally to fund day-to-day operations -- often a grouping of financial metrics overlooked during times of plenty – then becomes a center of intense focus when the availability and costs of financing suddenly disappear and companies must look inward for sources of funding.

As the #1 supply chain and operations consulting firm in North America we have extensive capabilities in analyzing and managing Net Working Capital (NWC) performance. We help company executives and investors in need of greater liquidity and flexibility through our unique approach.

Submit this form to speak to an SGS Maine Pointe consultant.

Prefer to call? (781) 934 - 5569

Why is working capital improvement important?

Investors, private equity firms, and lenders are finding that in the current environment of tighter lending practices, higher operational costs and logistics issues, cash is often locked up in inventory, receivables and payables.

In addition, higher interest rates have necessitated more caution in financing. Companies have recognized that because of these cash-limiting disruptions, the next obvious step is to take active strategic measures to optimize working capital and free-up cash.

How we add value

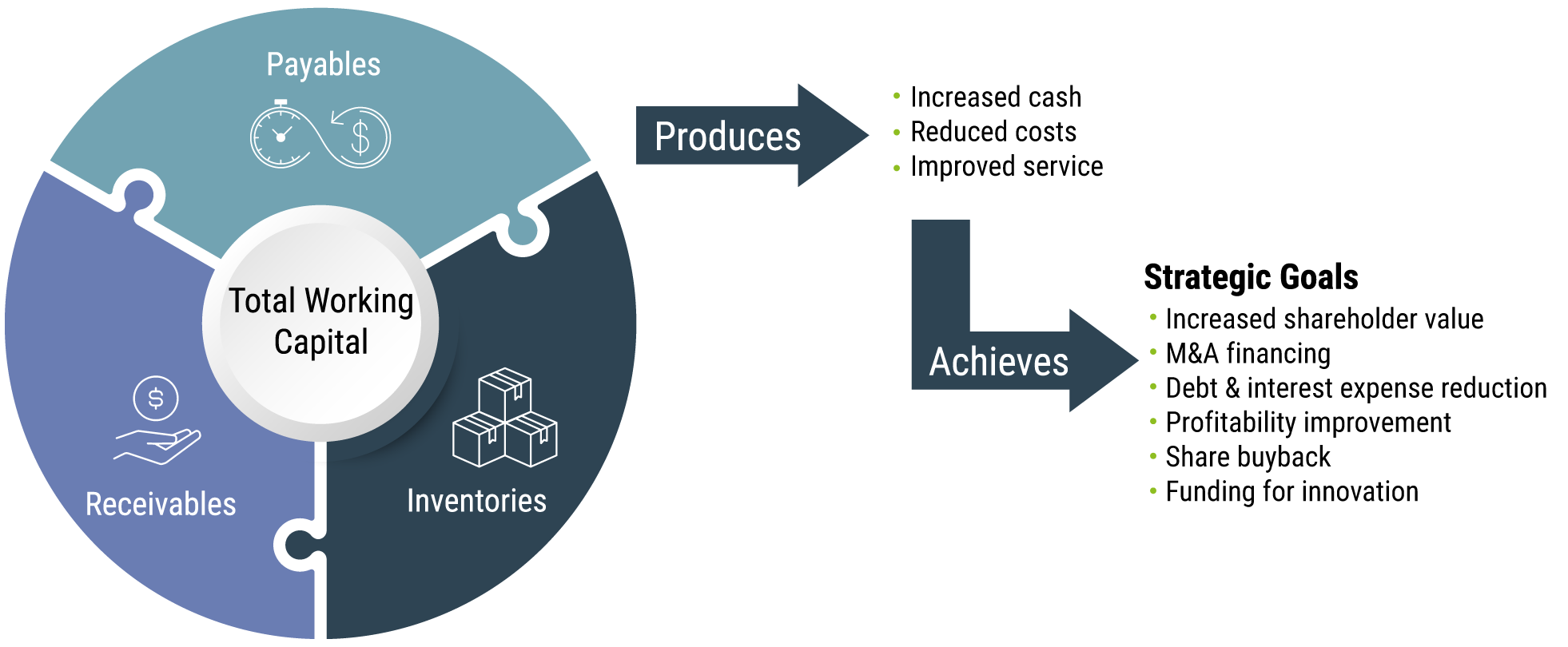

For management teams and investors (Private Equity and Direct Lenders) in need of greater liquidity and flexibility, our approach drives the triple impact of releasing cash, reducing costs and improving service levels – rather than a linear approach to managing working capital.

Our expertise and unique approach accelerates improvements across inventory, receivables and payables environments.

We typically deploy a 2-step approach to swiftly working through analytics then deliver initial cash results in as fast as 30 to 45 days.

Step #1: Rapid analysis

- Data analytics for company-level and cross-portfolio performance analysis & monitoring – for visibility, scenario planning & control

- Also applicable in due diligence environments

Step #2: Implementation

- Execution of inventory, payables and/or receivables initiatives to free up cash, reduce costs and improve service (one-time and continuous cash culture)

- Increase automation levels in data analytics dashboards for ongoing optimization

- Training and organizational development services to drive cash, cost & service culture

Inventory analysis and due diligence

We assess inventory performance and identify opportunities for immediate impact, ongoing performance improvement, and one-time disposition of slow-moving or obsolete inventory.

This allows you to:

- Analyze & understand the characteristics of your inventory by segment.

- Uncover root drivers of performance across sales, inventory, and purchasing.

- Find hidden gems and potential risks.

- Position for an implementation initiative.

Inventory reduction and optimization

Inventory management is a critical aspect of any business operation, and it can be a complex and challenging process.

Through our inventory optimization services, we help our clients minimize their inventory carrying costs while improving their overall supply chain performance. Our solutions include inventory forecasting, safety stock analysis, demand planning, and inventory level monitoring. With our help, our clients can achieve a leaner and more efficient inventory management system, resulting in improved customer satisfaction, increased profitability, and enhanced competitiveness in their respective markets.

Inventory projects we focus on

- SKU/Product Range Management

- Inventory Management

- Forecasting and Planning

- Sales Order Processing

- Materials Scheduling

- Manufacturing Execution

- Warehousing and Distribution.

Payables extension and harmonization

Payables extensions and harmonization are two main strategies that we use to improve your working capital.

Payables harmonization involves standardizing payment terms across multiple suppliers and customers, making it easier for you to manage your cash flow and reduce the risk of late payments. By harmonizing payment terms, you can improve working capital, reduce the risk of missed payments, and enhance relationships with suppliers.

Extending supplier payment terms improves working capital by allowing companies to utilize cash reserves longer, bolstering financial flexibility and solvency. It also reduces transaction costs through decreased payment frequency, minimizing bank fees and administrative work. This strategy, however, must be executed carefully to preserve supplier relationships and maintain supply consistency, enabling optimized cash-to-cash cycles and sustainable supply chains.

Payables projects we focus on

- Payment Term Management

- Early Pay Discounting

- Dynamic Discounting

- Payable Financing

- P-Cards

- Low-cost transaction channels

- Automated Procurement

- Strategic Sourcing Procurement.

Receivables reduction and customer service

Our approach to AR management focuses on maximizing the value and efficiency of all underlying processes.

To reduce accounts receivable volume and payment delinquency requires an improvement of customer creditworthiness, the use of advanced analytics to predict delinquencies, automating invoicing for efficiency, and establishing clear, flexible payment terms with multiple payment options to encourage timely payments. This results in improved cash flow and healthier working capital.

Receivables projects we focus on

- Contact Structuring

- Customer Terms Optimization

- Discounts Offered

- Multiple Payment Methods

- Factoring / Securitization

- Strategic Collections

- Dispute Management

- Automated Cash Application.

The Impact of Our Approach

10% - 25%

Increase in inventory turns improvement

15% - 50%

Payment terms extension improvement

15% - 30%

Days Sales Outstanding (DSO) improvement

Inventory disposition benefits

- Best price possible

- Expertise in SLOBs

- Global disposition strategies

Payment processing benefits

- Improve cycle time

- Lower transaction cost

- Consolidate tactical purchasing

Accounts receivable benefits

- Accelerate invoice clock

- Reduce disputes

- Maximize collection effectiveness

Additional benefits

- Lower debt interest and operating expenses

- Reduced asset requirements

- Gains in capacity

- Typically, self-funding initiatives

Working Capital Case Studies

| Company Description | Project Scope | Results |

|---|---|---|

|

Laminate Manufacturer |

Inventory |

|

|

Solar Film Producer |

Inventory |

|

|

Manufacturing Giant |

Payables |

|

|

Beauty Products Supplier |

Payables |

|

|

Marketing Services Provider |

Receivables |

|

Related Resources

Don't settle for less

SGS Maine Pointe believes single digit percentage savings targets set internally and accepted in board rooms are potentially too low.

We outline a path to 25-40% savings across supply chain and operations without impacting growth and resilience.

Working capital takes top priority in 2023

Dan Ginsberg, Managing Director, Private Equity at SGS Maine Pointe recommends switching to a more holistic, multidisciplinary approach. He explains why working capital optimization should be taken out of the CFO’s office and into the domain of every office and line of business within the company to release cash, reduce cost, and improve service.

2023 Priorities: Free Up Cash, Reduce Costs, and Improve Service

Many businesses and investors are finding that in an environment with tighter lending practices, higher interest rates, and inflated operational costs, that their cash is tied up in inventory, receivables, and payables. As a result, managing liquidity and raising free cashflow will be a top priority in 2023.

Ready to improve your working capital?

Talk to us

From rapid sprints for short-term gains to transformation for competitive advantage we are here to get you there.

Schedule a discussion

Submit this form to speak to an SGS Maine Pointe representative.

Prefer a call? (781) 934 - 5569