How we work with you

Maine Pointe delivers compelling results

Analyze

Implement

Maine Pointe drives 10% - 30%+ measurable cost improvement, accelerates revenue growth, and realizes capital efficiency gains across your portfolio through supply chain and operations improvement

Maine Pointe partners with investors, operators, and portfolio executives to drive measurable and sustainable performance improvement. We identify and take responsibility for the implementation of financial gains and operational value creation to deliver sustainable step-change in equity and enterprise value of your companies.

Average profitability growth

Improvement in near-term cash

Average ROI

In value creation delivered

Private Capital Experience

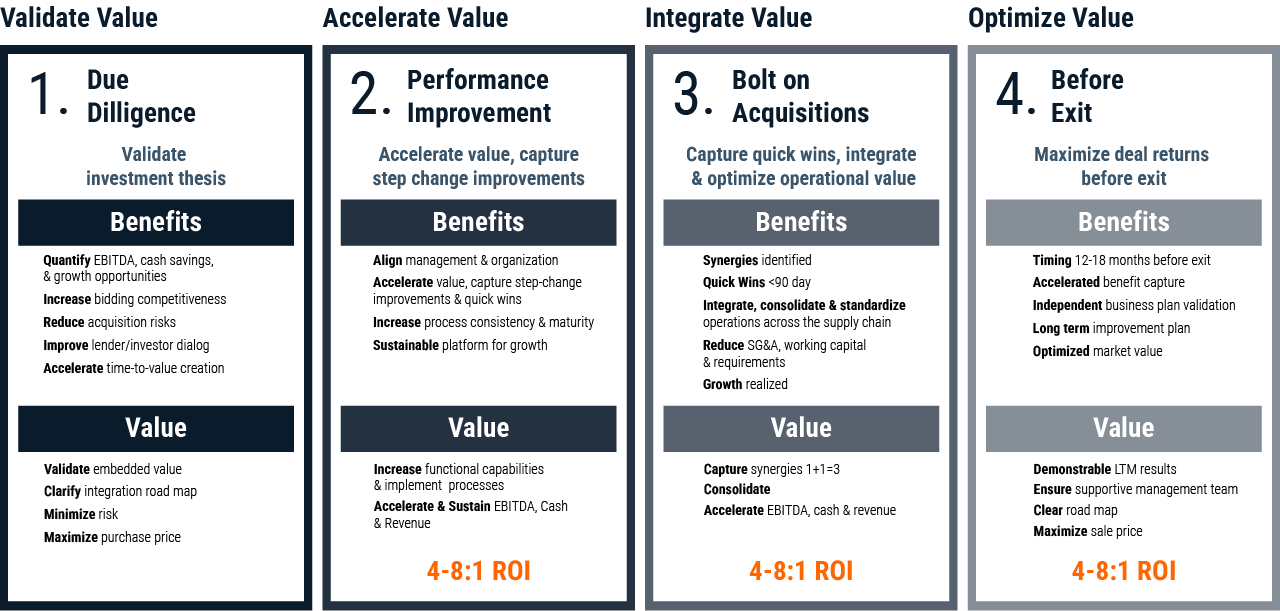

Improve exit quality, valuation multiples, and growth

Unique 100% fee-based guarantee

With 20+ years of Private Capital experience, Maine Pointe has worked with Private Equity firms, investors, family offices and portfolio companies, driving billions in enterprise value improvement globally.

Private Equity is at our core - and since our founding, Maine Pointe has delivered billions in benefits to over 300 companies and 75 PE firms across 30 countries.

We deliver 10%–30%+ cost improvements, accelerate revenue growth, and unlock capital efficiency across your portfolio.

Maine Pointe has delivered $Billions of benefits to over 300 companies and 75 PE sponsors operating in 30 countries around the world

Our data analytics and digital supply chain expertise unlocks actionable insights across multiple data silos and drives measurable results for life sciences companies to make real-time decisions.

Our in-depth analysis focuses on quantifying production, supply chain & planning gaps to drive performance and improve profitability, cash, resilience & growth with 6:1 average ROI.

Our pragmatic and unique Total Value Optimization™ implementation methodology is designed to drive life sciences companies to greater efficiency, resilience and profitability.

Our use of subject matter experts (SMEs) with extensive Private Capital experience provides strong credibility and deep insights to achieve measurable results (average 25 years of experience).

Our leader and organization improvement (LOI) process aligns cross-functional operations with suppliers with common goals and ensures sustainable change.

Our unique 100% engagement fee guarantee mitigates the risk of the investment required to capture value.

Driving measurable and sustainable change

Have a particular business challenge you'd like to address?

Submit this contact form to speak with one of our executives.