Baby Boomer Retirement and Opportunity for Private Equity

By 2029, the majority of so called baby boomers (those born between 1946 and 1964) will have reached retirement age. Combined with current low interest rates and high liquidity, this is creating a perfect storm for mid-market PE buyers who are well placed to take advantage of new deal-sourcing opportunities from smaller, family-owned businesses. With a decade of potentially self-sustaining market opportunities ahead, now is a great time to launch a middle-market fund.

A decade of opportunities lies ahead

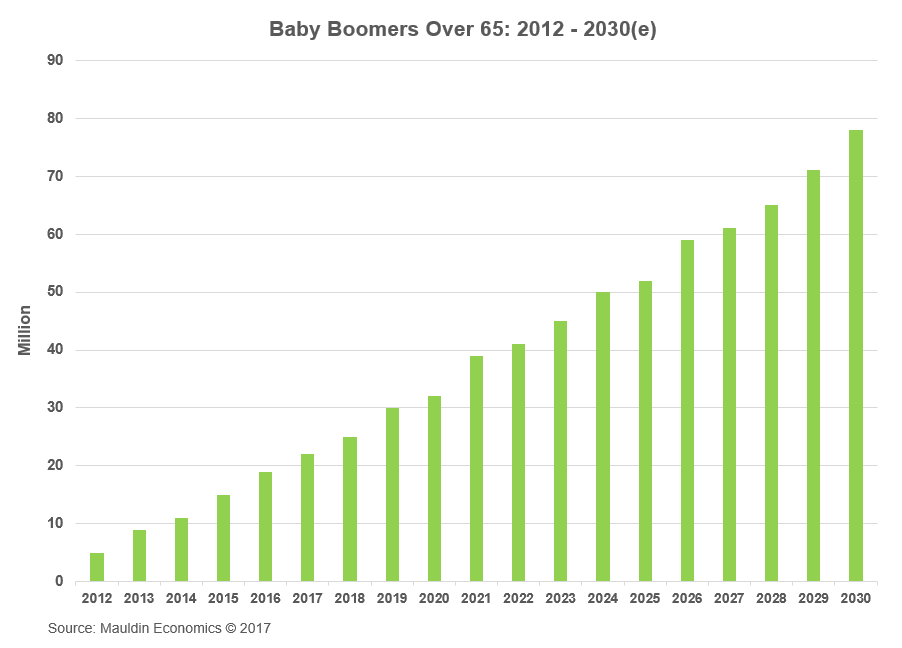

As the graph below shows, the baby boomer retirement rate is picking up and will continue to rise rapidly in the coming years. According to the US Small Business Administration, small businesses represent 99.7% of all businesses in the country. A 2016 survey of small businesses in the United States indicated that, while 54% of small business owners intended to leave within 10 years, 72% didn't have an exit plan. In short, we have a succession crisis which means there are going to be a lot more businesses in the small to middle market available for purchase.

PE Sponsors

For PE firms, the upside of acquiring owner-led businesses is that many are debt free, with loyal customers and tested and proven business models. In addition, the person selling the business may be willing to stay on as an advisor since they spent their entire life building that business. The downside is that supply chain and operations may not be organized in the most efficient, dynamic way and the culture of the company may differ greatly from the PE firm's idea of how things should be done. Restructuring the organization, while retaining its key people and customer loyalty, can be a challenge. This is especially true if a lack of data availability and reporting make it difficult to find answers to key financial questions.

Owners preparing a business for sale

Many business owners are aware of the impact low supply chain maturity can have on the value of their business. They would like to professionalize/improve their business but aren't sure how to go about it. A supply chain and operations consulting firm can help achieve a higher level of capability much faster than if they were to try and tackle this alone.

Accelerating the process helps improve competitiveness and meet growth objectives. It also helps development in crucial areas such as leadership, organization structure and data analytics. For example, if you are being acquired or merged, your PE sponsor is going to want clear visibility across your organization. Can you present all the data they will need in one place to help decision making and drive actionable insights? Finally, are you ready to relinquish control of your business?

A critical decision

In our experience, when PE sponsors merge multiple family-owned business into one entity, one of the most urgent decisions they need to make is who is going to be in charge. For example, we worked with one client formed by the merger of four family-owned businesses in the consumer goods industry where the founders of all four business had been retained. This was a great decision in terms of ensuring continuity and reassuring customers and employees. However, it resulted in an extremely complex organization structure and major integration challenges in terms of processes, technology and people.

When it comes down to it, however attractive a PE buyout may seem, founders often find it difficult to relinquish companies they've spent a lifetime building, so there's a lot of risk in converting a family-run business into a well-run organization. As a result, many private equity firms would rather spare themselves the headache and buy mature companies.

However, alongside the risk, there is the potential for great reward. Companies in this market are often sold at a discount which means, if you can achieve alignment, there is the potential for significant value creation.

Understand the challenges you face

Both company owner and PE sponsor stand to gain if they are realistic about the organizational challenges ahead from the outset. Navigating your way to an integrated, mature supply chain is never easy. Sometimes you may need support from an experienced third party, like Maine Pointe, that understands the challenges each party faces and can help bridge communication gaps between founder and PE sponsor for mutual advantage.

Contact us if you are a PE sponsor or a company owner and would like to learn more about how we can help you take advantage of this opportunity.

About Us

Maine Pointe is a global supply chain and operations consulting firm trusted by many chief executives and private equity firms to drive compelling economic returns for their companies. We achieve this by delivering accelerated, sustainable improvements in EBITDA, cash and growth across their procurement, logistics and operations. Our hands-on implementation experts work with executives and their teams to rapidly break through functional silos and transform the buy-make-move-fulfill supply chain to deliver the greatest value to customers and investors at the lowest cost to business. We call this Total Value Optimization (TVO)™.

Maine Pointe's engagements are results-driven and deliver between 4:1-8:1 ROI. We are so confident in our work and our processes that we provide a unique 100% guarantee of engagement fees based on annualized savings. www.mainepointe.com